Pay off your home faster with INHP’s unique Mortgage Accelerator program

Would you like to pay your home off faster and pay less interest over time? Traditional mortgages generally feature a fixed interest rate over a 30-year term. With INHP’s Mortgage Accelerator, you can pay off your home in as few as 20 years if you qualify and purchase your home using an INHP home loan.

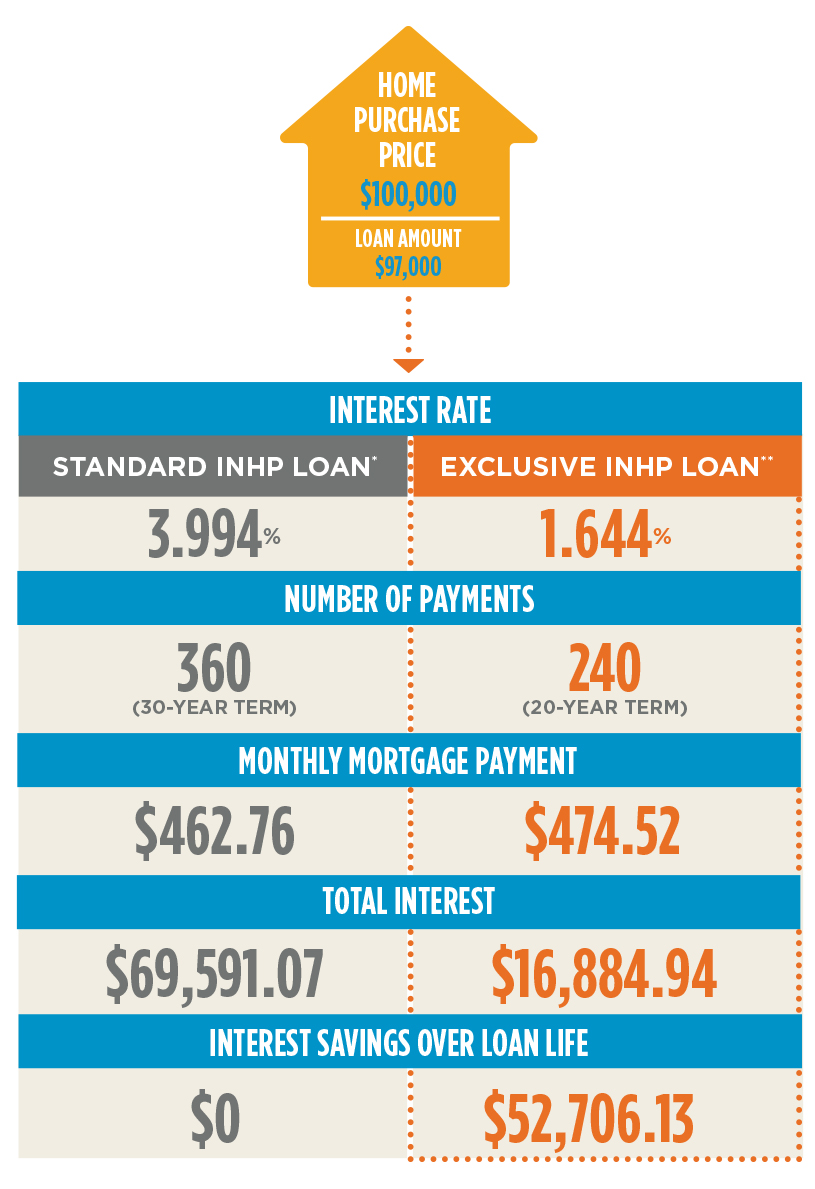

Check out this example of a home with a purchase price of $100,000 and see how the mortgage accelerator could help you save money and pay off your home faster. Or, click here for an example of a home with a purchase price of $150,000.

Learn more about INHP’s home loan programs. If you’re ready to talk with a loan officer to see if you qualify for the mortgage accelerator, contact an INHP loan originator.