2019 ANNUAL REPORT

CREATING MORE SAFE AND AFFORDABLE HOUSING OPTIONS

INHP's mission is to increase affordable and sustainable housing opportunities for individuals and families, and serve as a catalyst for the development and revitalization of neighborhoods.

Dear Friends,

The past few months of 2020 have reminded us that a person’s housing situation is one pillar to their economic and social well-being. Being able to afford the place you call home is essential to the choices you make, especially in times of need.

We examined affordability more than ever in 2019. Through research, we know the amount of housing cost burdened households in Marion County keeps rising while median home values continue to be out of reach for low- and moderate-income families. There is a critical need for education and more affordable housing options.

INHP is addressing these realities as a champion for affordable housing. We make data-driven decisions in partnership with the people and places we serve. We innovate to bring together the ideas, talents and resources of many and unify them under a common goal: To enhance the neighborhoods of our city.

Together, we are making our city a place we are proud to call home.

Moira Carlstedt

President and CEO

PROVIDING PEOPLE THE POWER TO CHOOSE WHERE THEY WANT TO LIVE

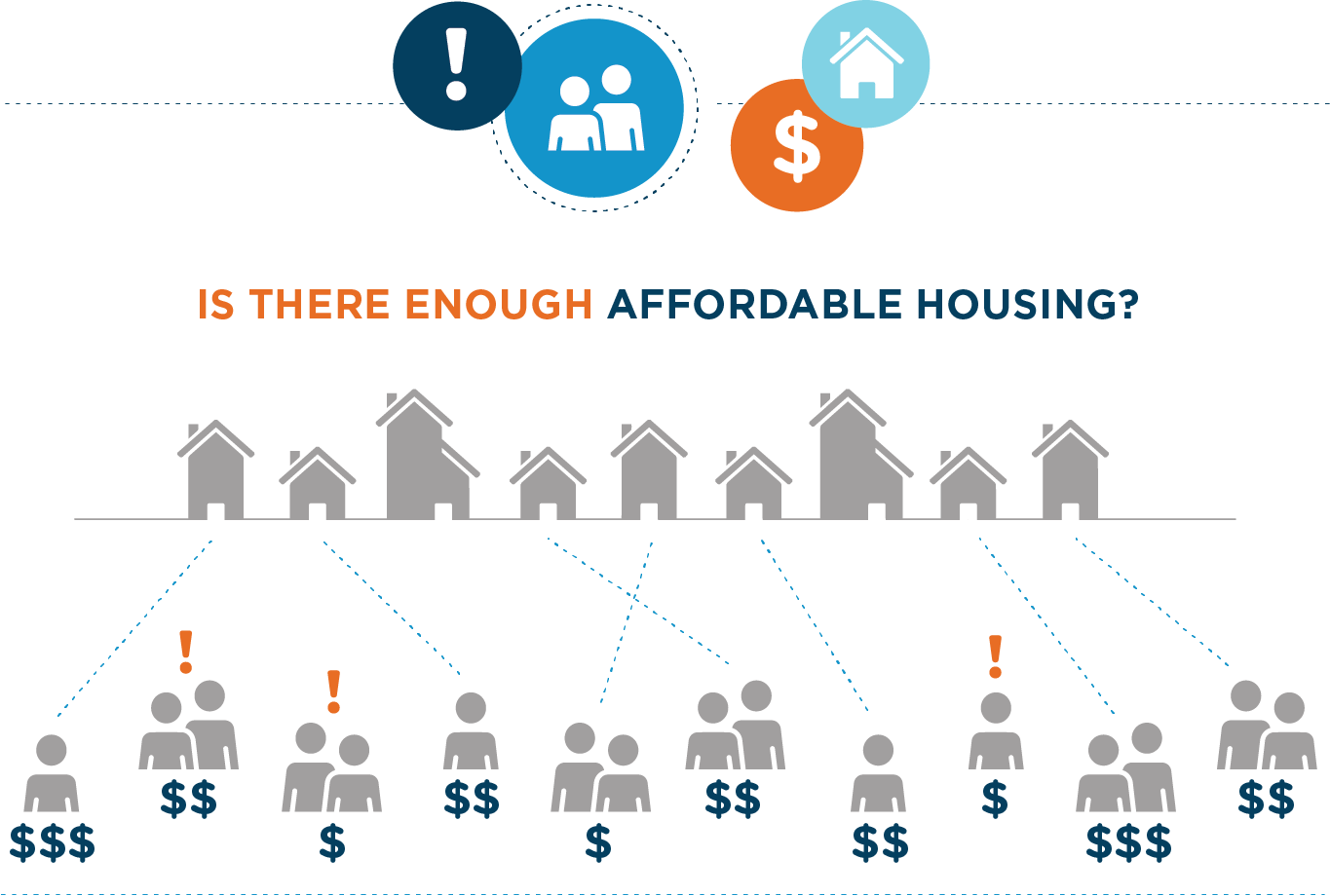

The power to choose where you want to live is a powerful thing. Our key strategies are built upon that principle, informed by data and responsive to our community’s need. According to recent data, more than 31% of Marion County households are low- and moderate-income AND spend more than 30% of their income on housing. Even more, renters comprise 70% of those households. This reveals a housing cost-burden challenge, and one that has grown during the past few years.*

*Source: Greenstreet, LTD.

Real estate market data reinforces that the affordable housing stock is not aligned with the demand. The number of homes that are available for sale that our families can afford has continued to decline. While 213 families finished INHP’s advising program in 2019, many of them found the cost of a home in a neighborhood that met their needs was more than they could afford.

KEY STRATEGIES

HOMEBUYER EDUCATION, ADVISING & LENDING

We provide comprehensive, practical, goal-driven direction that empowers people to remove credit barriers, explore the homebuying process, and select and close on an affordable home mortgage.

We offer post-purchase support to help families protect their investment long after they close on their home.

We also support current homeowners and promote neighborhood stabilization by providing low- and moderate-income people access to affordable loans to make home repairs.

COMMERCIAL LENDING

We provide financing that supports site acquisition, construction, bridge or permanent debt that primarily yields affordable housing.

DIRECT INVESTMENT

We develop affordable single-family homes, and we hold sites for strategic development or preservation of multifamily homes.

GRANTS

We provide grants to nonprofits dedicated to affordable housing preservation or development and neighborhood-based placemaking.

KEY STRATEGY

HOMEBUYER EDUCATION, ADVISING & LENDING

INHP is committed to helping low- and moderate-income people understand their homeownership potential and purchasing power.

HOMEOWNERSHIP DEVELOPMENT

We enable clients to become knowledgeable homebuyers while preparing them to sustain their investment.

SINGLE-FAMILY LENDING

We provide qualified low- and moderate-income people access to loan programs to purchase or repair a home

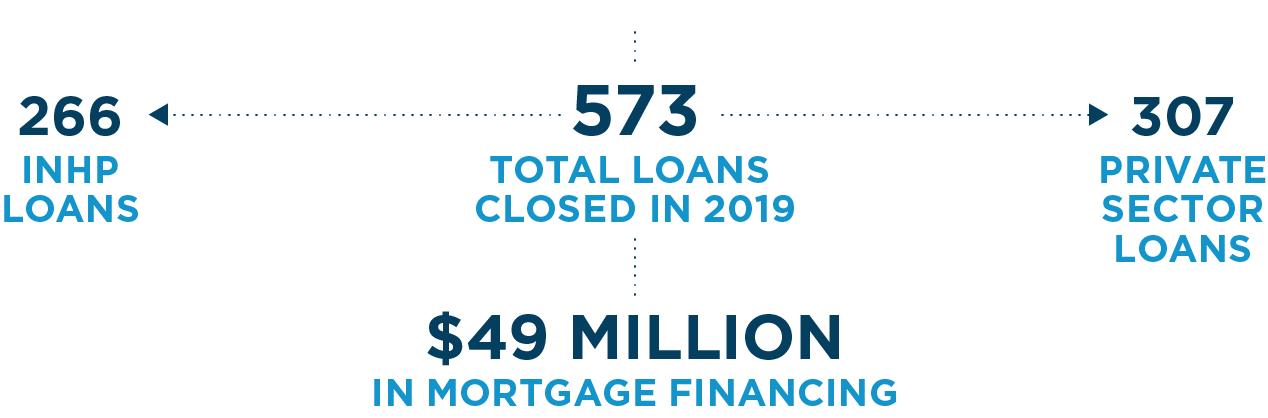

LENDING DEMOGRAPHICS:

WHO WE SERVED IN 2019

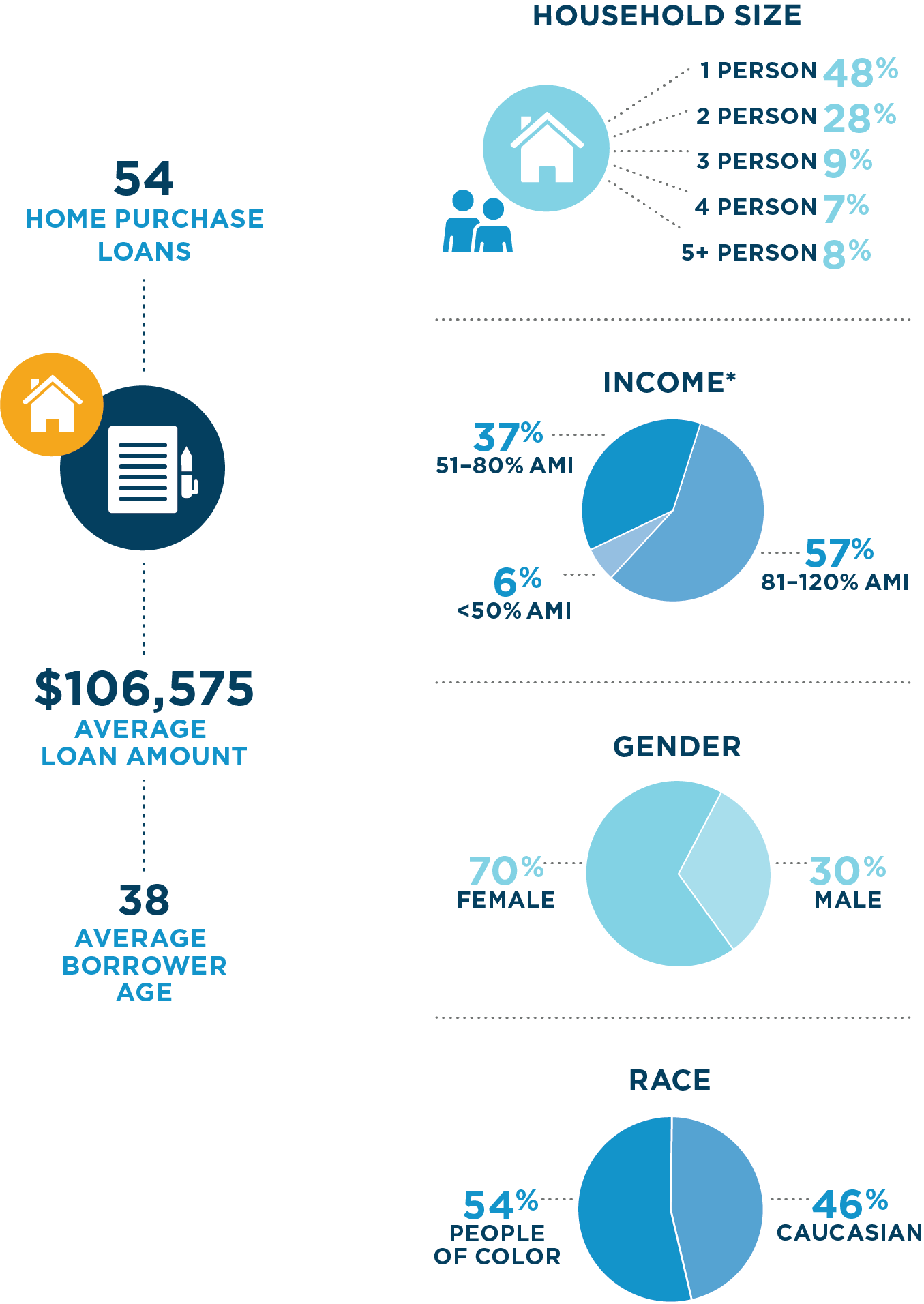

DEMOGRAPHICS: INHP home purchase loans

*AMI = Area Median Income.

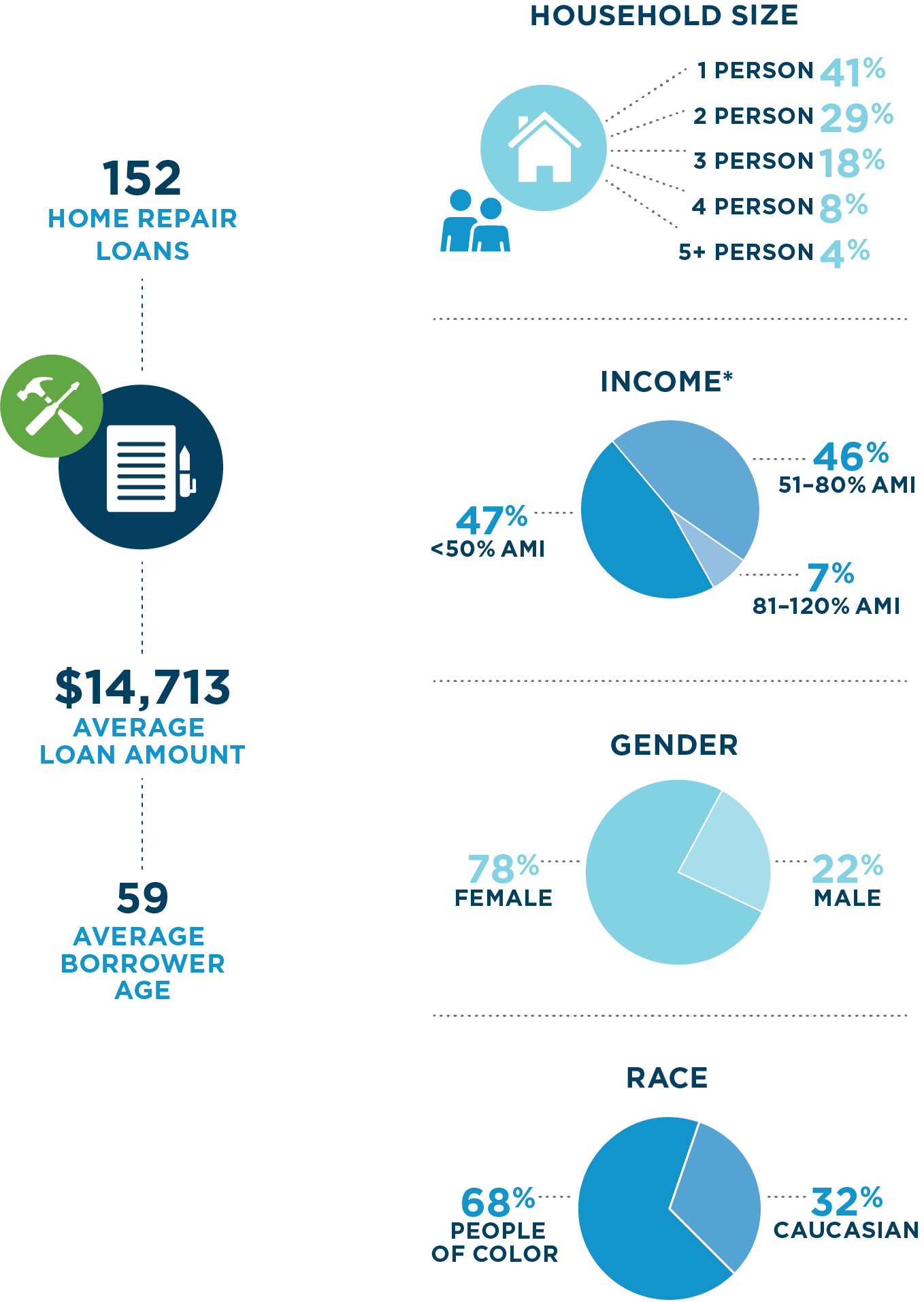

DEMOGRAPHICS: INHP home repair loans

*AMI = Area Median Income.

Recent graduate Kelly was able to navigate student loan debt and purchase her first home.

Glen trusts INHP to be the additional resource he needs to help his clients achieve homeownership.

Bonnie worked with INHP’s rehab team to make repairs to the home she loves.

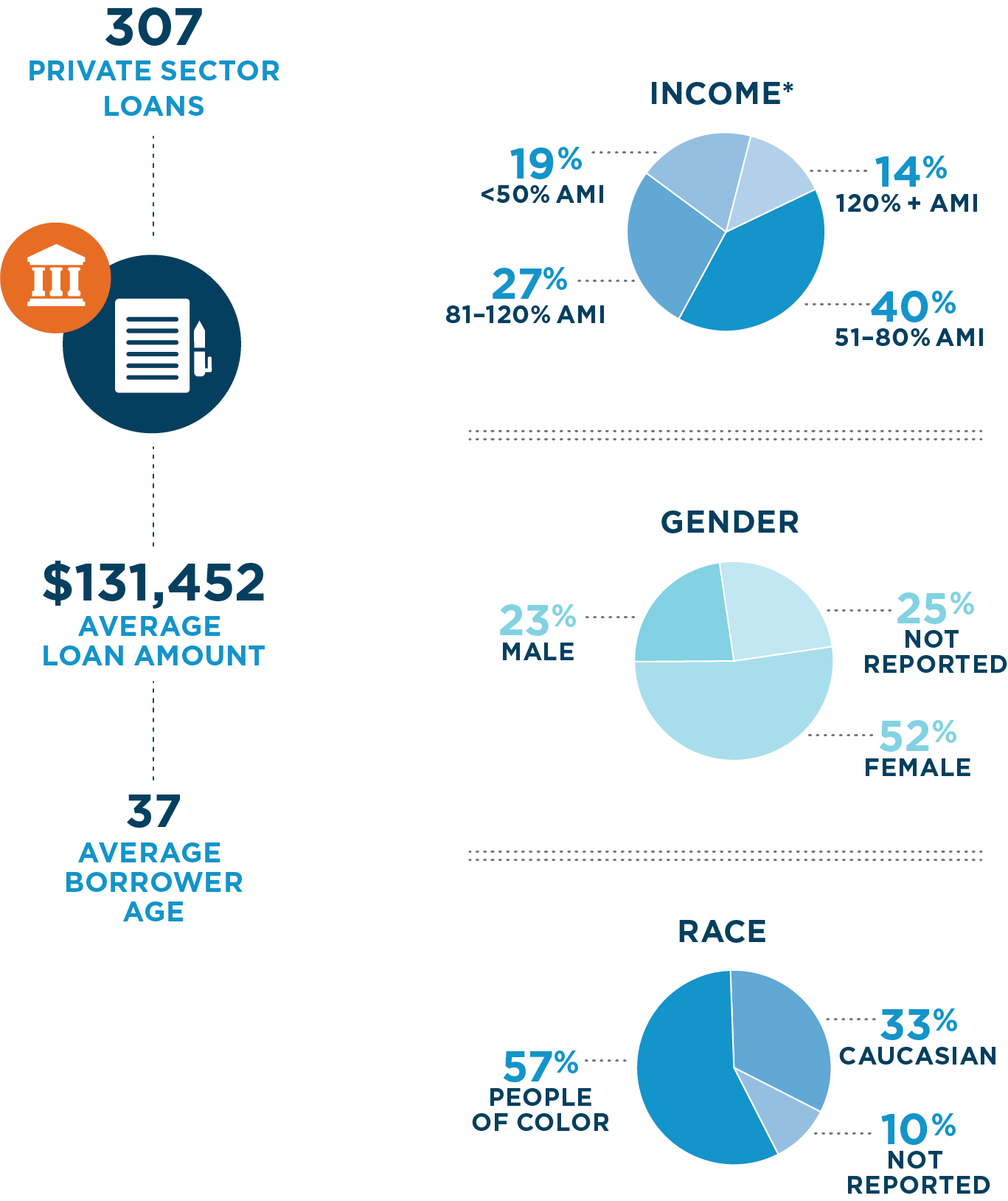

DEMOGRAPHICS: private sector loans

Local banks partner with INHP to offer competitive loan options, so we can offer our clients more mortgage options.

*AMI = Area Median Income.

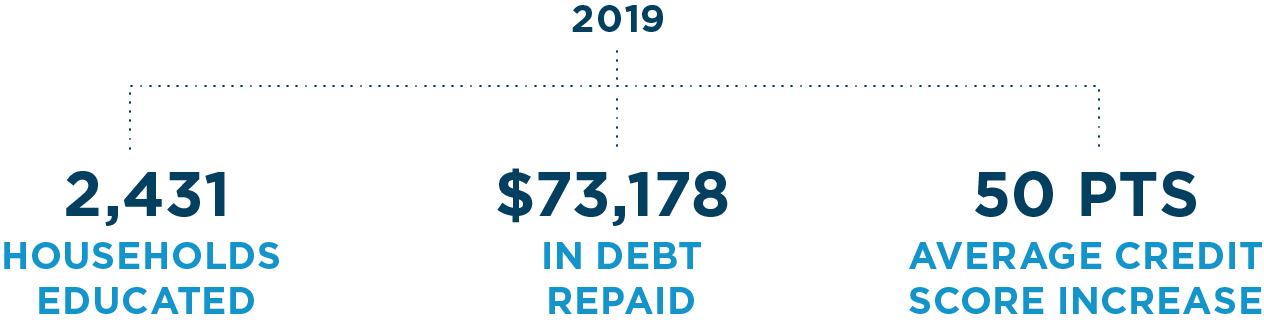

INHP’S ADVISING STAFF IS HUD CERTIFIED

Through our Homeownership Development team, we enable homebuyers to establish a healthy financial future and become educated and knowledgeable consumers. In 2019, every member of this team earned a HUD Certified Housing Counselor accreditation, ensuring our clients receive expert counsel.

KEY STRATEGY

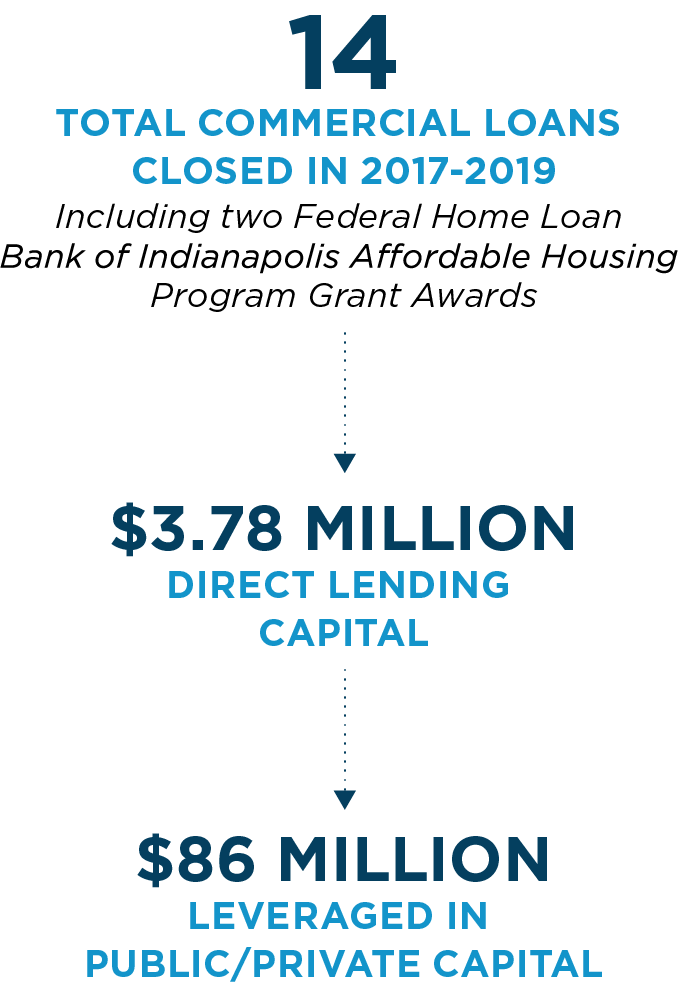

COMMERCIAL LENDING

INHP creates development and reinvestment opportunities by providing commercial lending options to help respond to each neighborhood’s unique needs.

MORE CAPACITY, MORE FLEXIBILITY

Indianapolis’ neighborhoods have varied and unique plans for developing affordable housing. INHP continued to respond to community priorities in 2019 by offering a broader range of financing options.

As a U.S. Treasury certified community development financial institution (CDFI), INHP helps qualified nonprofits finance affordable housing initiatives. We provide construction financing, land loans, working capital and patient capital to support affordable housing development. Below are a few of the organizations we closed commercial loans with in 2019.

NWQOL

Holding

Company

ACHIEVING COMMUNITY BASED DEVELOPMENT ORGANIZATION STATUS

In 2019, INHP was granted CBDO status by the City of Indianapolis and the Indiana Housing & Community Development Authority. This recognition means we engage in community development activities that improve the physical, economic or social environment, with an emphasis on the needs of low- and moderate-income people.

WELCOMING RIVER FISH TO RIVERVIEW

In 2018, our investment in RiverView, a partnership with Strategic Capital Partners, LLC, and Goodwill of Central and Southern Indiana, helped bring over 200 workforce apartments to downtown Indianapolis. In 2019, new public art designed by University of Indianapolis faculty – River Fish – was installed in front of the apartments, giving homage to the local fishing culture. Moira was invited to help welcome the new cultural amenity to the neighborhood.

RENOVATIONS UNDERWAY TO SERVE AT-RISK NEIGHBORS

INHP helped finance Partners in Housing’s renovations for Blue Triangle and Mozingo Place apartments so they could continue to serve a critical population – very low-income people and those experiencing homelessness. Once complete, 72 housing units will be available in Indianapolis’ downtown and near east areas.

“With INHP’s support, we were able to keep these units affordable with minimal debt and continue to provide opportunity for our most vulnerable neighbors.”

Kait Schutz, Director of Real Estate Development for Partners in Housing

KEY STRATEGY

DIRECT INVESTMENT

INHP is creating opportunities for individual homeowners and neighborhoods with targeted investments across the city.

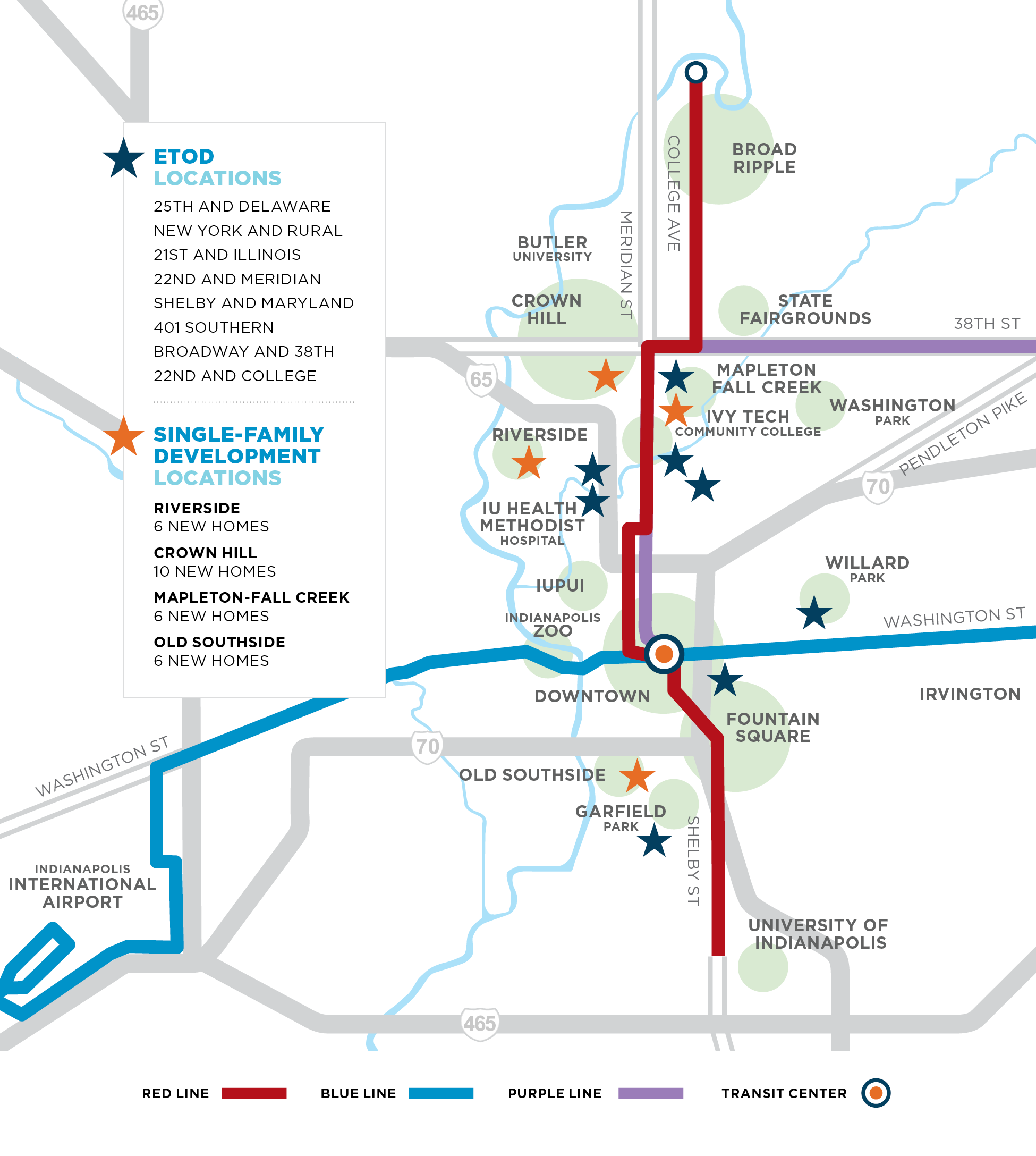

AFFORDABLE HOUSING ALONG MASS TRANSIT LINES

In 2019 we officially announced our Equitable Transit-Oriented Development (ETOD) fund and purchased eight properties for future affordable housing opportunities near high-frequency transit routes. As properties are completed, residents will have easier access to jobs, healthcare, schools, and other Indianapolis amenities, and lower annual transportation costs.

NEW CONSTRUCTION

In partnership with the Crown Hill, Riverside and Old Southside neighborhoods, we invested in the construction or rehabilitation of 28 new, affordable single-family homes. These houses create new opportunities for buyers while helping neighborhoods reach their plans and goals. Check out floorplans from the Old Southside and Riverside neighborhood homes.

SHARING OUR SUBJECT-MATTER EXPERTISE

Moira joined several of our partners — Big Car Collaborative, Near East Area Development and Eastern Star Church — for a panel presentation at Hamilton County’s HAND, Inc. affordable housing conference. She had the opportunity to talk about specific ways INHP has supported each organization in creating innovative affordable housing strategies in their respective neighborhoods.

KEY STRATEGY

GRANTS

Because of our data-driven, partnership culture, we're trusted with philanthropic funds to strategically deploy into our community to positively impact the affordable housing system.

Partnership is in our name. But more importantly, partnership is a part of our culture.

INDI GRANTS

- Greater Indianapolis Habitat for Humanity

- King Park Development Corporation

- Near Eastside Collaborative Partnership

- Near North Development Corporation

- Riley Area Development Corporation

- Renew Indianapolis, Inc.

- Southeast Neighborhood Development, Inc.

- Westside Community Development Corporation

Read more about how we’re supporting local partners to enhance our community’s quality of life.

$900,000 in operating support

to eight partners constructing, rehabbing and maintaining affordable housing units.

COMMUNITY GRANTS

- Brookside Community Development Corporation

- CICOA

- Edna Martin Christian Center

- Groundwork Indy

- Harrison Center for the Arts

- Hearts and Hands of Indiana

- Indiana Legal Services, Inc.

- Indianapolis Legal Aid Society

- International Marketplace Coalition

- Kennedy King Memorial Initiative

- Martin Luther King Community Center

- Midtown Indianapolis, Inc.

- Neighborhood Christian Legal Clinic

- Pathway to Recovery

- Rebuilding Together Indianapolis

- South Indy Quality of Life Plan

- Southeast Neighborhood Development, Inc.

- Trinity Haven

- United Northeast Community Development Corporation

$322,000 to support affordable housing and placemaking activities.

TECHNICAL ASSISTANCE GRANTS

- Midtown Indianapolis, Inc.

- Martindale Brightwood Community Development Corporation

- Near North Development Corporation

- Old Southside Neighborhood Association

- Southeast Neighborhood Development, Inc.

INHP granted more than $35,000 in support of initiatives that strengthen housing opportunities.

PARTNERSHIP GRANTS

- LISC Indianapolis

- Neighborhood Christian Legal Clinic

More than $180,000

to help our allies serve

the community with us.

WE ARE CHAMPIONS FOR AFFORDABLE HOUSING

INHP is honored to serve the people and places of Indianapolis. Working together, INHP and partners are making Indianapolis a place we're proud to call home.

EVALUATING AND ANTICIPATING NEED

ALWAYS INNOVATING

As a Community Development Financial Institution (CDFI), INHP is constantly looking for ways to meet the evolving needs of our community and the changing financial landscape. This includes piloting new programs in collaboration with other like-minded organizations in support of our mission, leveraging our seasoned relationships and establishing new ones.

ALWAYS INFORMED

INHP stays at the forefront of affordable housing conversations by sourcing formal research and sharing it with others. Visit our Research Library to explore how housing connects to health care, education, economic mobility and more.

INHP’S ANNUAL COMMUNITY BREAKFAST

Each year, we use our Community Breakfast to celebrate our partnerships, promote our mission and advance the conversation of a people- and place-based approach to affordable housing. At the 2019 Community Breakfast, an INHP panel discussed the impact of our initiatives.

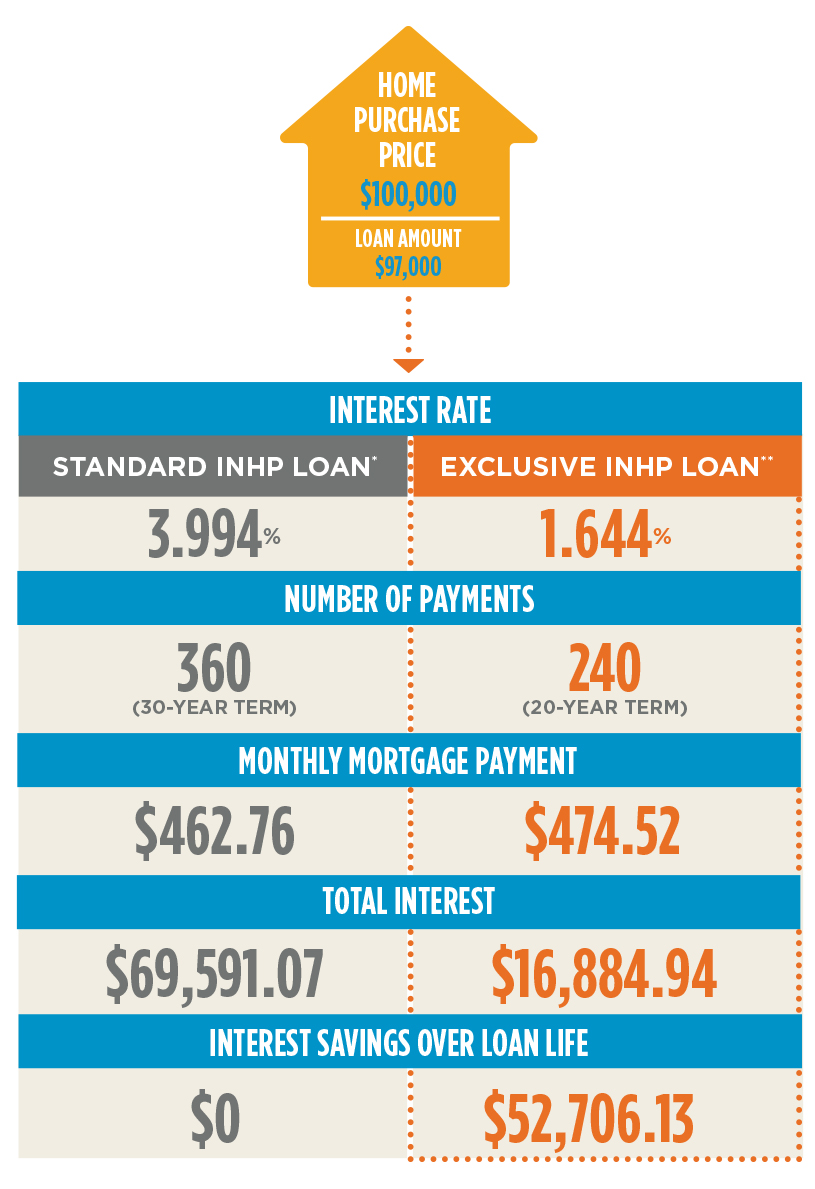

MORTGAGE ACCELERATOR PROGRAM

We know our low- to moderate-income clients are well-equipped to afford a traditional 30-year mortgage after completing our program. Shorter loan terms may cause payment shock or exceed their debt-to- income ratio. INHP designed a fixed-rate Mortgage Accelerator program that would give clients the option of a 20-year term. By significantly reducing the interest rate, we can offer a shorter repayment term without the corresponding increase in their principle and interest payment. This will help clients save tens of thousands of dollars and build wealth.

The program was piloted in 2019 to serve interested buyers in partner initiatives like Anchor Housing and our three New Markets Tax Credit neighborhoods where we built 29 new homes. After a successful pilot, we were awarded a U.S. Department of Treasury grant to make our Mortgage Accelerator program available across Marion County in 2020. We’ll be able to offer eligible homebuyers a 20-year fixed-rate mortgage loan with a payment that is nearly identical to a 30-year mortgage.

THE ANCHOR HOUSING PROGRAM

From 2016 to 2019, INHP, Indy Chamber and eight active nonprofit anchor institutions partnered to help strengthen homeownership opportunities. Through the Anchor Housing program, these anchors encouraged their employees to become or remain part of their workplace neighborhoods.

- Butler University

- Community Hospital East

- Crown Hill Foundation

- Eskenazi Health/Health & Hospital Corporation of Marion County

- IUPUI

- Marian University

- Newfields

- University of Indianapolis

The commitment and belief in this initiative leveraged over $2 million collectively in Down Payment Assistance and home repair loans to low- and moderate-income people in Marion County, which is more than 100 families impacted. See the impact the Anchor Housing program had on three Indianapolis families.

BRING THE HEAT A SUCCESS

For more than 12 years, we’ve partnered with the Indiana HVAC Association, IPL and Citizens Energy to help low-income families prepare their homes’ heating systems for winter through “Bring the Heat” day. On Oct. 5, 2019, we did it again, and we had the pleasure of including new partners Indianapolis Fire Department and CLEAResult Energy Advisors through IPL.

Volunteer teams visited nearly 150 homes to check furnace function and safety, check and/or replace smoke and carbon monoxide detectors, and assess the home's energy efficiency. After crews completed their visits, eight furnaces were flagged for major repair or replacement — a life-saving effort by all those involved.

“What a luxury to head into winter relaxed about my furnace instead of anxious about maintenance and repair costs.”

Bring the Heat participant and homeowner

COMPREHENSIVE SUPPORT IN ACTION ON THE OLD SOUTHSIDE

INHP first engaged with the Old Southside in 2015 to support area partners who wanted to establish a neighborhood plan. Our involvement came full circle in 2019 when the neighborhood was awarded a Lift Indy grant through the City of Indianapolis. Our comprehensive homeownership strategies are now at work in the neighborhood, including new affordable homes developed with Davis Homes, mortgage lending, homeownership education for homebuyers, and repair loans for existing low- and moderate-income homeowners.

REPAIRING A 100-YEAR-OLD HOME

Old Southside resident, Wayne, knew he needed to make repairs to his home. It was challenging for him to find the right time because of his fixed income. Through INHP’s Old Southside repair program — in partnership with the City of Indianapolis — Wayne was able to:

- Replace his HVAC system

- Repair plumbing problems

- Address lead-based paint

- Install floor supports

- Replace basement steps

“I’m happy to have my house back in working order.”

Wayne, Old Southside resident

FINANCES AND DONORS

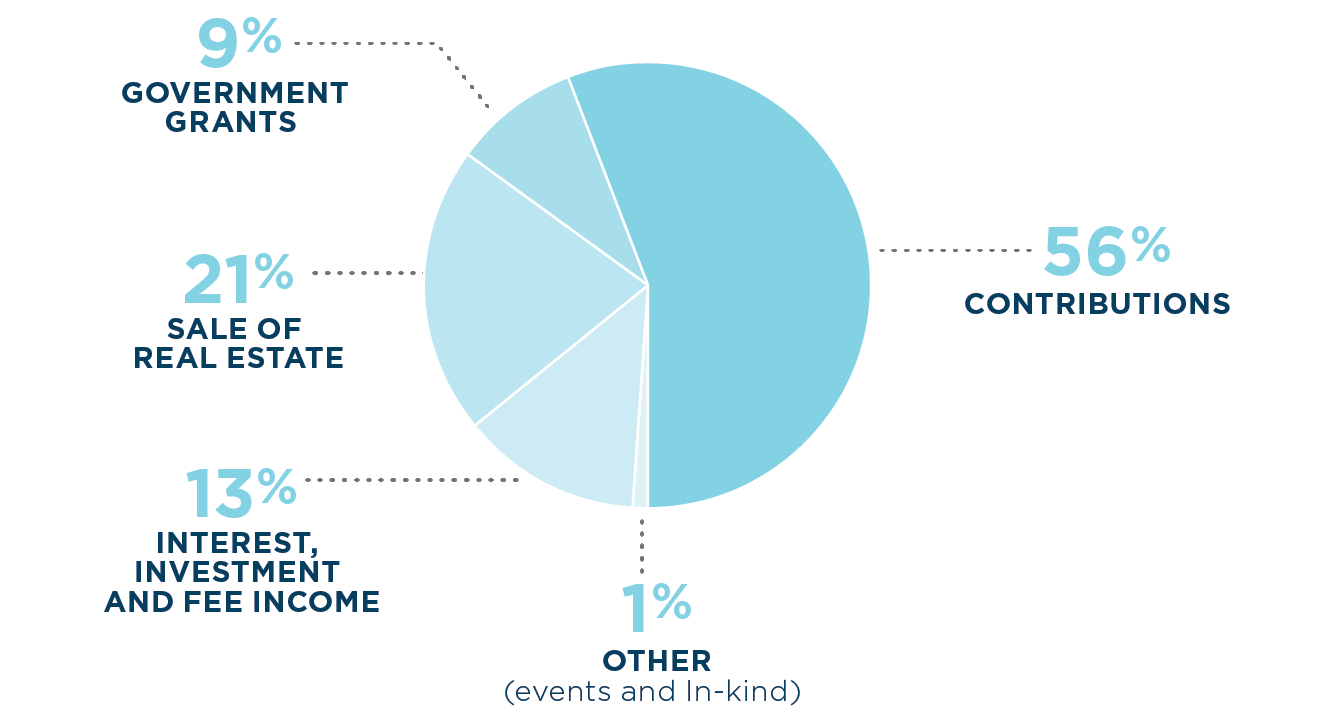

REVENUE, GAINS & OTHER SUPPORT

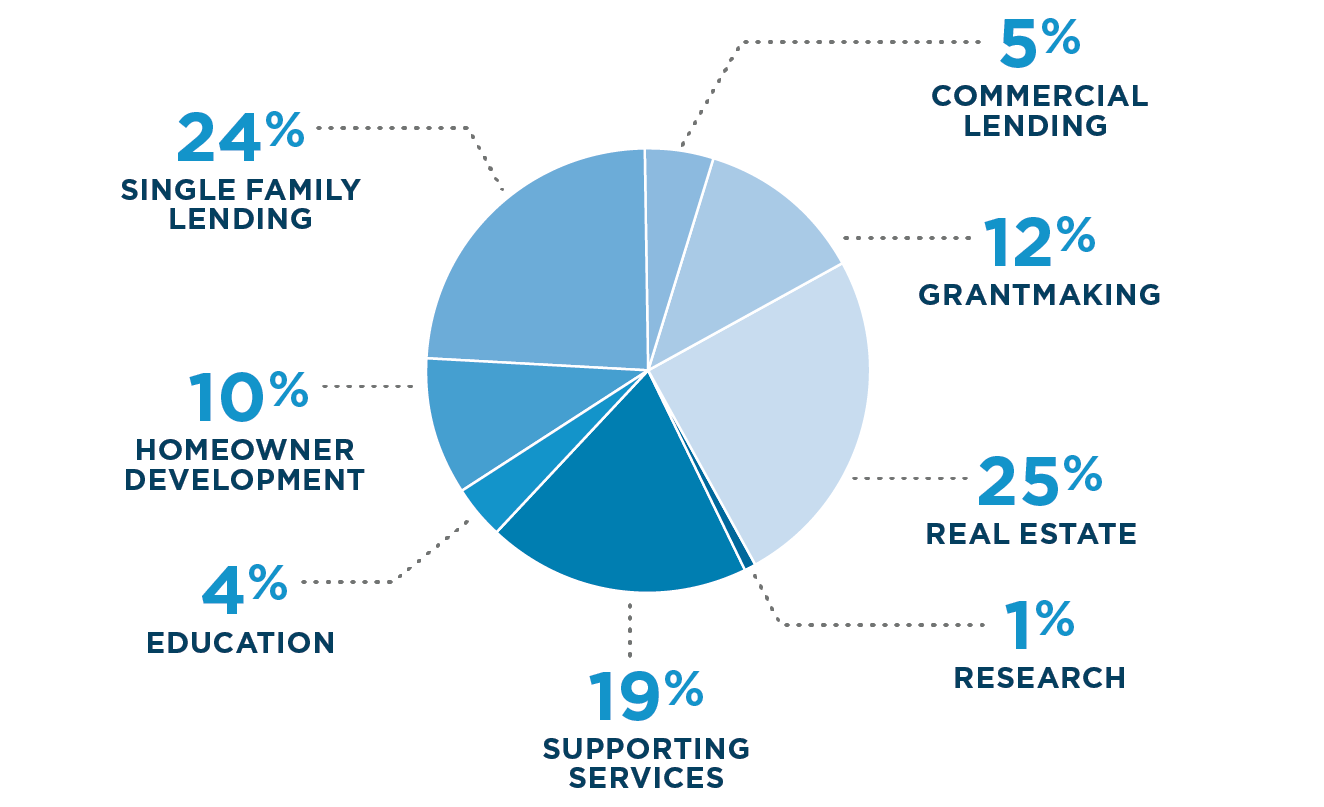

EXPENSES & OTHER COSTS

BOARD OF DIRECTORS

Bruce Baird

COO

Renew Indianapolis, Inc.

Jeff Bennett

Deputy Mayor of Community Development

City of Indianapolis

Bill Bower

Market President

First Financial Bank

Steve Campbell

Vice President of Communications

Indianapolis Colts

Moira Carlstedt

President and CEO

INHP

John Corbin

Region President

The Huntington National Bank

Lacy DuBose

Vice President Agency Sales, North Central Market

State Farm

Greg Fennig

Chief Marketing,

Communications and

Community Relations Officer

United Way of Central Indiana

Juan Gonzalez

Market President,

Central Indiana

KeyBank

Jennifer Green

Executive Director

Partners in Housing

– Indianapolis

Dr. Dawn Haut

CEO

Eskenazi Health Centers

John Hirschman

President & CEO

Browning

Mali Jeffers

Vice President of

Corporate Responsibility

Ambrose Property Group

Jeffrey L. Kittle

President & CEO

Herman & Kittle Properties, Inc.

Mark Kugar

Commercial Banking

Indiana Market Executive

BMO Harris Bank

Dr. Kathleen Lee

Chancellor, Central

Indiana Region

Ivy Tech Community College

Nicole S. Lorch

COO

First Internet Bank

Dr. Robert Manuel

President

University of Indianapolis

Anthony “Tony” Mason

President & CEO

Indianapolis Urban League

BOARD OF DIRECTORS (cont.)

Gina Miller

CFO & COO

United Way of Central Indiana

Paul Okeson

Executive Vice President

Garmong Construction Services

Michael F. Petrie

Chairman

Merchants Capital Corp.

Albert Smith

Chairman

JPMorgan Chase Indiana

Joseph Whitsett

Retired

Marshawn Wolley

Director of Community Engagement and

Strategic Initiatives

Indiana University Paul H. O’Neill

School of Public and Environmental Affairs

ADVISORY BOARD

Thomas C. Dawson

Executive Vice President and Chief Administrative Officer

Strada Education Network

Kenneth Herrmann

Senior Vice President, Commercial Real Estate Sales Manager

Fifth Third Bank

Mary Jo Kennelly

Retired

Mary Lisher

Retired Partner

Faegre Drinker Biddle & Reath LLP

Shelley Specchio

CEO

MIBOR REALTOR® Association

David Skeels

Founder, President

Vayurjant Capital Partners

Lynne Tamanini

First Vice President & Manager

The National Bank of Indianapolis

WITH YOUR HELP, WE WERE ABLE TO SERVE NEARLY 2,800 PEOPLE DURING 2019.

SPECIAL THANKS TO OUR DONORS

$1,000,000 or more

Lilly Endowment Inc.

$100,000 to $999,999

City of Indianapolis

Community Development Financial Institutions Fund (CDFI)

Federal Home Loan Bank of Indianapolis,

in honor of Moira Carlstedt

KeyBank

KeyBank Foundation

$50,000 to $99,999

Housing Partnership Network

Huntington Bank

The Cummins Foundation

Wells Fargo

$25,000 to $49,999

BMO Harris Bank

Fifth Third Bank

Fifth Third Bank Foundation

First Merchants Bank

Marion County Public Health Department

State Farm

Union Savings Bank

$1,000,000 or more

Lilly Endowment Inc.

$100,000 to $999,999

City of Indianapolis

Community Development Financial Institutions Fund (CDFI)

Federal Home Loan Bank of Indianapolis,

in honor of Moira Carlstedt

KeyBank

KeyBank Foundation

$50,000 to $99,999

Housing Partnership Network

Huntington Bank

The Cummins Foundation

Wells Fargo

$25,000 to $49,999

BMO Harris Bank

Fifth Third Bank

Fifth Third Bank Foundation

First Merchants Bank

Marion County Public Health Department

State Farm

Union Savings Bank

$10,000 to $24,999

Bank of America

Citimark

Indianapolis Power & Light Company

JPMorgan Chase & Co.

OneAmerica

PNC

David W. and Jennifer F. Skeels

The Carlstedt Family

The Indianapolis Foundation, a CICF affiliate,

in honor of Marshawn Wolley

The Sablosky Family Foundation, a fund of the Hamilton County Community Foundation

$5,000 to $9,999

Ascension St. Vincent

Citizens Energy Group

Eli Lilly and Company

Robert and Angela Evans

First Financial Bank

Herman & Kittle Properties, Inc.

Jennett and Alan Hill

Indy Chamber

Jeffrey Kittle

Mary K. Lisher

MIBOR REALTOR® Association

Nicholas H. Noyes, Jr., Memorial Foundation

Old National Bank

Regions

Al and Maribeth Smith

The Brave Heart Foundation

$2,500 to $4,999

American Structurepoint, Inc.

Associated Bank

Barnes & Thornburg LLP

BKD

Bose McKinney & Evans LLP

Care Institute Group, Inc.

Community Health Network

Eastern Star Church

Eskenazi Health

Faegre Drinker Biddle & Reath LLP

First Internet Bank

Lois Hanson

Horizon Bank

Indianapolis Airport Authority

Indianapolis Local Initiatives Support Corporation

Klapper Family Foundation, Inc.

Samerian Foundation

The National Bank of Indianapolis

University of Indianapolis

Joe Whitsett

$1,000 to $2,499

Michael Alley

Jeff Curiel and Kate Kester

Davis Building Group

Tim and Amy Diersing

Endress+Hauser, Inc.

Greg Fennig

Flaherty & Collins Properties

Nichole M. Freije

John and Barbara Gallina

Greg Gault and Jeanne Maurer-Gault

Joseph and Stacey Hanson

Mr. Kenneth Herrmann

John Hirschman

Morgan and Brandon Hoover

Indiana Farm Bureau Insurance

IndyGo

Robert P. Kassing

Kite Realty Group

John L. Krauss

Mark Kugar

Lake City Bank

Sam and Kim Laurin

Dr. Kathleen Lee

Benjamin A. Lippert

Nicole Lorch

LUNA Language Services

Robert Manuel

Joy and Tony Mason

Charles Mercer

Merchants Capital Corp.

Alan O’Rear

Michael F. Petrie

Kenny and Cherie Pologruto

Chris Purnell

Mr. and Mrs. N. Clay Robbins

Stephen H. Simon

Steve and Tina Sullivan

Sun King Brewing Company

$500 to $999

Ambrose Property Group

Barb Armbruster

Deb and Ron Berry

Browning

Busey Bank

Centier Bank

John Corbin

CRIPE Architects and Engineers

Don and June Dawson

Stephen Doughty

Lacy DuBose

John and Palak Effinger

Freije Brands

Genevieve and Dan Gaines

Jeff and Judy Good

Gregory Home Inspections, Inc.

Dawn P. Haut

Ivy Tech Community College

Mary Jo Kennelly

Jennifer and Jeffery Meeker

Martita and Trevor Meeks

Merchants Bank of Indiana

Monarch Beverage

Moser Consulting

Neighborhood Christian Legal Clinic

Mr. Jeffery J. Qualkinbush

Mr. and Mrs. David G. Sease,

in honor of Moira Carlstedt

Stifel

Strategic Capital Partners

The Peterson Company

Marilyn Welker

Ms. Ruth Wooden

$1 to $499

Jeffrey Abrams

Stephanie Adams

American Construction

Nicole Annen

Deborah Armbruster

Associated Insurance Services, LLC

Association of Fundraising Professionals – Indiana Chapter

Bruce Baird

Eric Baiz

Lee Ann Balta

Alex and Amy Barrett

Jeff Bennett

Ms. DeBorah Y. Benson

Bernard Health

Beatrice Beverly

Big Car

Summer Black

Richard Block

Scott Blyze

Sherry Boudoin

Bill Bower

Brackets for Good

Mr. Mark Bradford

Bertie Broadhurst

Susan Brooks

David and Donna Butcher

Butler University

Angela Byers

Steven Campbell

James & Lynda Carlino

Amy Carpenter

James Carr

Esther L. Carter-Day

Center for Leadership Development

Rori Chaney

Suzanne Chebat

Kyle Cheverko

Katie Chrisco

Paul Chrisco,

in honor of Katie Chrisco

CICOA

Cinnaire

Shelby Clifford

Michael Cloud

ClusterTruck

Laura and Greg Cochran

Amy Conrad Warner

Todd Cook

Lynne A. Coverdale

Timothy Coxey

Renee Davis

Thomas Dawson

Shandy Dearth

Tara DeBoo

John Dietzen

Stephanie Dillon

Thomas and Nancy Dinwiddie

Ms. Melinda Douthitt

Jason Dudich

David J. Duncan

Norma and Michael Duncan

Mary Durell

Bea Dye

Mary Anne Ehrgott,

in honor of Deb Berry

Kyle Elkins

Kathleen Elrod

EmployIndy

Ms. Judith Essex,

in memory of Richard Essex

Lacey Everett

Cassandra Faurote,

in honor of Jennifer Meeker

Federal Reserve Bank of Chicago

Margie Fee

Aaron J. Feldman,

in honor of Moira Carlstedt

Victoria Fenty

Nashelle Frazier

John and Stacy Frazier

LaTasha Freeman

Mr. William French

Fusion Alliance Inc.

Mike Garrett

Melissa, Jon and Emerson Geitgey

Shakila Germany

Jay and Susan Geshay

Joe Giacoletti

Kevin Givens and Kellie Givens

Mr. and Mrs. Joseph W Glaser

BriAnna Glenn

Patrick Goble

Juan Gonzalez

Goodwill Industries of Central Indiana, Inc.

Courtney Gordon

Greater Indy Habitat for Humanity

Jennifer Green

Rob Green

Greenstreet Ltd.

Erika Gregory

Betty and Scott Groff

Groundwork Indy

Tom Guevara

Ashley Gurvitz

Hambone’s Trivia

Hamilton County Area Neighborhood Development

Lindsie Hammans

Dan L. Hampton

Ryan Hanson

Whitney Harden

Fred Hash

Dan Hatfield

Samuel and Margaret Hazlett

Hearts & Hands of Indiana

Aleatha Henderson

Mary Henehan

Brian Henning

Steve Hoeferle

Jennifer Holcomb

Ms. Sherry L. Hopkins

Jadira Hoptry,

in honor of Fifth Third Bank

Will Huberty

Bonita Hurt

Matthew Husband

Impact Old Southside

Indiana Housing and Community Development Authority

Indianapolis Housing Agency

Indy Gateway

Insight Development Corporation

IUPUI

Rita Jackson

Mali Jeffers

John Boner Neighborhood Centers

Thomas and Kellie Johnson

Jenny Jones

Mrs. Laurie Jones

David Jose

Keep Indianapolis Beautiful, Inc.

Mo Keithley

Tom Kientz

David Kiley

Marcus King,

in honor of Sherry Loller

Rachelle Kippe

Marlyn K. Kiskaden,

in honor of Deb Berry

Matt Kleymeyer,

in honor of Jennifer Meeker

Kurt Kreilein

Kroger

Christine Laker

Dr. and Mrs. Ned Lamkin

Ms. Deborah Lawrence

Robin Lawrence

Robin Ledyard

Tammy Lieber

Sherry Loller

Ruth and Ralph Lusher,

in honor of Melissa Turner

Chris Maddox

Marian University

MarketWatch

John Marron

Will Marts

Ms. Kimberly Mathews

Thomas Maxwell

Scott McCain

Pat McClosky

Michele McFarland

Daniel McInerny

Michael McKillip

Mary McLeish

Sarah McWhorter

Carolene Mays-Medley

Julia Melendez

Edith Melvin

Michaelis Corporation

David Miller

Gina Miller

Jennifer Miller

Justin Moed

Susan Monik

Jacob Moore

Sarah Mordan-McCombs

Eleena Morse

Donna Mwaafrika

Mary Myers

Mr. David Nash

National Association of Women,

in honor of Moira Carlstedt

Near North Development Corporation

NeighborLink Indianapolis

Spencer Newmister

Nora Kroger

Sean Northup

Eric Odmark

Paul Okeson

Molly Overbey

Manoj and Varsha Pandya

Partners in Housing

Greg Pastor

Brian and Gail Payne

Bob Pedigo,

in honor of Stacy Frazier

Pepper Construction Company of Indiana

Michael Petrie

Ronna Pope

Powers & Sons Construction Co. Inc.

Steve Pratt

Andrea Props

Katie Quillen

Cameron Radford

Chris Ragland

Rebuilding Together

Kimberly Reeves

William and Courtney Reeves

Phillip W. Reid

Gary Reiter

Rebecca A. Richardson

Andrea Riquier

Ms. Lee Robinson

Mark and Brenda Rodgers

Deborah Ross

Priscilla Russell

Donte Samuel

Mark and Julanne Sausser

Darnae Scales

Kelly Schenkel

Schmidt Associates Inc.

Melody Schulz

Teia Sebree

Servants At Work, Inc.

Ralph Shiley

Simon Property Group

Len and Constance Smith

Southeast Neighborhood Development, Inc. (SEND)

Shelley Specchio

Susan Springirth

Margaret Staab

Jennifer Stamm

Kerri Stone

Ted Sturges

Kristofer Karol and Caitlyn Stypa

Justin Sufan

Lynne Tamanini

Leopoldo Tamez

Phil Terry

Scott and Sharon Thiems

Christa Thomas

Vivian Thomas

Tiffany Thompson

Jen Tigay

Anthony and Melissa Turner

Tracy Uhrig

United Way of Central Indiana

Chrissy Vasquez,

in honor of INHP Staff

Brandi Vierling

Adam Vizard

Mark Vopelak

Steve Wagoner

Travis Walker

Michele Wann

Angela Wethington

John Whitaker

White River State Park

Lori White

Malybu White,

in honor of Center for Leadership Development

Rick Wittgren

D. Wolfarth

Jacob Wolfarth,

in honor of Debbie Wolfarth

Helen Wolfe,

in honor of Deb Berry

Gary and Lynn Woodworth

Shannon Zajicek

Jennifer Zentz

Gift in-kind

Anonymous

Anonymous

Barb Armbruster

Alex and Amy Barrett

Beech Grove Bowl

Deb and Ron Berry

Bluebeard Restaurant

Bose McKinney & Evans LLP

BRICS

Buck Creek Winery

Butler Arts Center

The Carlstedt Family

Chicago Cubs

ClickDimensions

Climb Time Indy

Laura and Greg Cochran

ComedySportz Indianapolis

Conner Prairie

Cooper’s Hawk Winery & Restaurants

Timothy Coxey

Crew Carwash

Cumulus WZPL

DeBrand Fine Chocolates

Duos Kitchen

Effectv

John and Palak Effinger

Eiteljorg Museum of American Indians and Western Art

Emmis Communications

Faegre Drinker Biddle & Reath LLP

Fat Dan’s Deli

Margie Fee

Fountain Square Theatre Building

Freije Brands

Fun Factory

Genevieve and Dan Gaines

Mike Garrett

Melissa, Jon & Emerson Geitgey

BriAnna Glenn

Greatimes

gregperez|studio

Ryan Hanson

Holiday World & Splashin’ Safari

Morgan and Brandon Hoover

Ms. Sherry L. Hopkins

Ice Miller, LLP

iHeart Media

Illinois Street Food Emporium

Indiana Farm Bureau Insurance

Indiana Historical Society

Indiana Pacers

Indianapolis Colts

Indianapolis Indians

Indianapolis Marriott Downtown

Indianapolis Motor Speedway

Indianapolis Symphony Orchestra

Invoke Studio

Thomas and Kellie Johnson

Kroger

Lash & Brow Design Co.

Robin Lawrence

Lindleworks, LLC

Live Nation

Maximize LLC

Jennifer and Jeffery Meeker

Julia Melendez

MIBOR REALTOR® Association

Michaelis Corporation

Microsoft

Morellis Cleaners

NCAA Hall of Champions

Nestle Inn

Newfields

Spencer Newmister

Pinheads

Pinnacle Catering Group

Chris Ragland

Rascal’s Fun Zone

Regions

Rhythm! Discovery Center

Riolo Dance Studio

Ms. Lee Robinson

Saffron Cafe

Sherry Loller

David W. and Jennifer F. Skeels

Len and Constance Smith

Sun King Brewing Company

The Children’s Museum of Indianapolis

The Peterson Company

The Tie Dye Lab

Anthony and Melissa Turner

Tuttle Orchards

University of Indianapolis

WISH-TV

D. Wolfarth

Ms. Ruth Wooden

Wooden & McLaughlin LLP

X-Site Amusement Center