Use a mouse, arrow keys or a touchpad to scroll through the pages.

EMPOWERING MARION COUNTY’S RESILIENT

FAMILIES AND NEIGHBORHOODS

DEAR FRIENDS,

Renters, homebuyers and homeowners who seek guidance from INHP are motivated to look to the future. In spite of current challenges and past experiences, their determination pushes them forward to accomplish their goal of increased housing stability today and every day ahead.

2020 was an unparalleled year for INHP, and we drew inspiration and understanding from the individuals and households keeping their goals in focus. They emboldened us to continue looking toward the future with confidence, data and skill — standing side-by-side with the Indianapolis community — to create access to stable, equitable and affordable housing now and for generations to come.

Thank you for supporting our mission and believing in the future of Marion County’s resilient families and neighborhoods.

Moira Carlstedt

President and CEO

RESPONDING THROUGH A PANDEMIC:

WE’RE HERE TO HELP YOU STAY ON TRACK

We carried this message into the community throughout 2020, never wavering in purpose and program delivery. For more than 30 years, INHP has been a trusted homeownership resource, and we remained committed to helping current and future homeowners navigate and stay on track towards their homeownership goals.

A record number of clients returned for post-purchase advising, emergency budgeting, and resources posted to a special crisis webpage.

We created a liquidity loan program and COVID-19 impact grants for community partners that were operationally adjusting to continue serving people who needed and desired affordable, stable housing.

To understand the potential impact of COVID-19 on evictions and foreclosures in Marion County, we commissioned research and shared the data with our community partners to help inform an emergency response for renters and homeowners.

Using federal CARES Act funding, the City of Indianapolis, Greater Indy Habitat for Humanity and INHP developed the Indy Mortgage Relief Program to administer three months of mortgage payment relief to homeowners affected by the pandemic.

KEY STRATEGIES

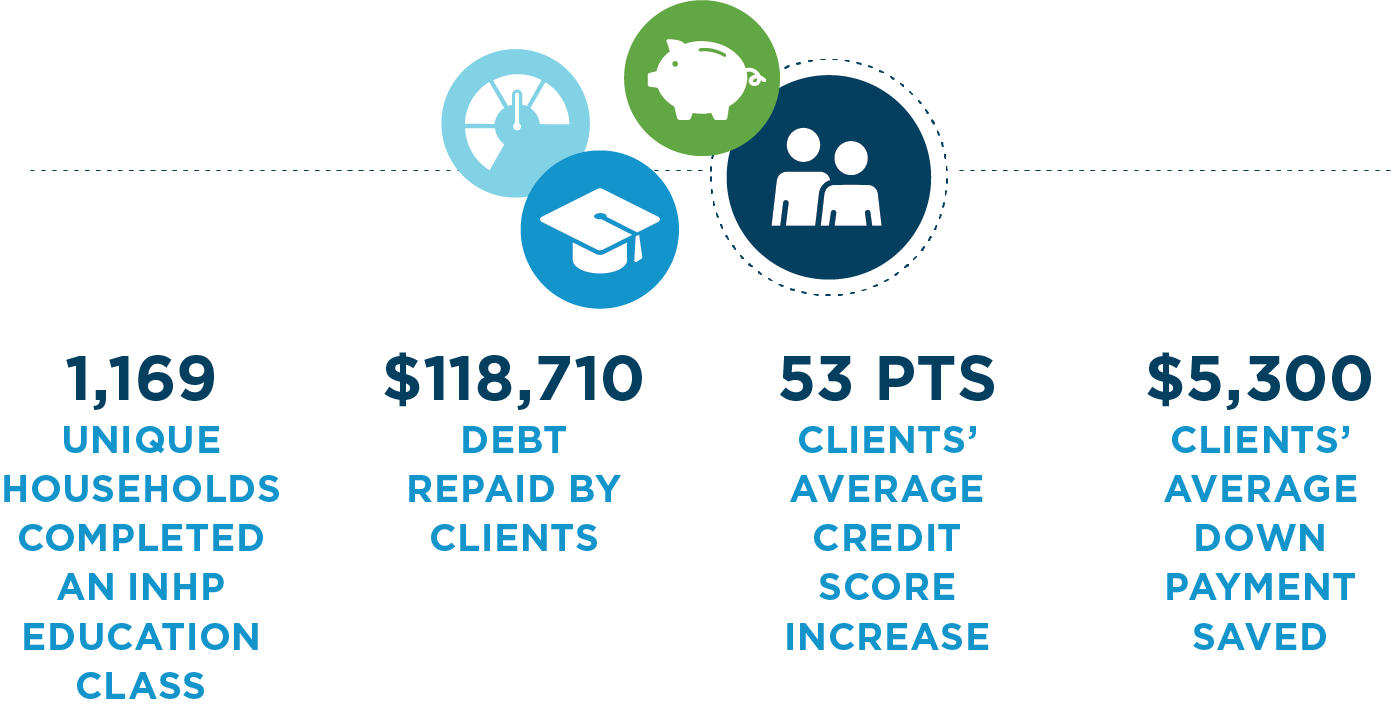

HOMEBUYER EDUCATION & ADVISING

Comprehensive, practical, goal-driven direction that empowers people to remove real and perceived barriers to homeownership

HOME PURCHASE & HOME REPAIR LENDING

Affordable and innovative mortgages for people to access capital, build wealth, sustain their investment and promote neighborhood stabilization

SINGLE-FAMILY HOUSING DEVELOPMENT

Direct investment and expertise, partnering with neighborhoods, to build new homes in response to the shortage of affordable homes in Marion County

LAND BANKING

Property acquisitions near rapid transit lines which allow time for strategic development and preservation of affordable multifamily housing

COMMUNITY LENDING

Financing that supports site acquisition, construction, bridge or permanent debt that primarily yields affordable housing

GRANTMAKING

Philanthropic funds for nonprofits dedicated to affordable housing preservation or development and neighborhood-based placemaking

OUR MISSION: To increase affordable and sustainable housing opportunities for individuals and families, and serve as a catalyst for the development and revitalization of neighborhoods.

WHO WE SERVE: INHP serves people with low and moderate incomes.

KEY STRATEGY:

HOMEBUYER EDUCATION & ADVISING

INHP is committed to helping people with low and moderate incomes, who are disproportionately Black people and people of color, understand their homeownership potential and purchasing power.

EDUCATION AND ONE-ON-ONE ADVISING

We enabled clients to become knowledgeable consumers while preparing them to sustain their housing investment.

LOSS MITIGATION

We provided INHP mortgage holders post-purchase advising when life events happened so they could remain in the homes they worked hard to purchase.

- 185 families gained advice and financial strategies to help them navigate or avoid mortgage delinquency, especially as COVID-19 and other unplanned expenses affected their budgets.

- We built a robust webpage and shared knowledge with homeowners, homebuyers and renters throughout the pandemic.

Shortly after settling in their new home, COVID-19 threatened Shawn and Erinn's ability to maintain their mortgage. When Shawn lost his job, they sought help with INHP's post-purchase advisor. That support was critical to keeping their home and renewing their confidence as homeowners.

Deanna listened to INHP’s advice to get her finances in order so she could pick the right home in her budget.

KEY STRATEGY:

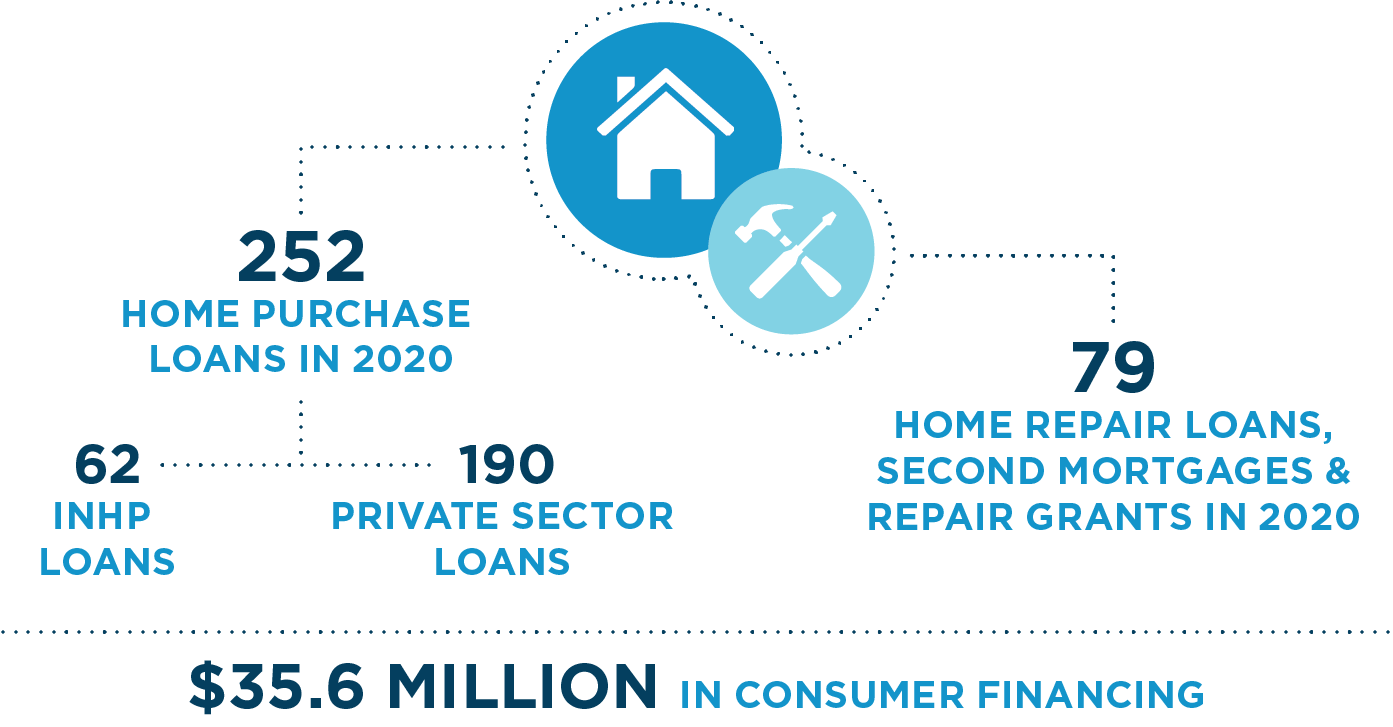

HOME PURCHASE & HOME REPAIR LENDING

Equitable, innovative and responsible lending, through INHP and our private sector lending partners, provides people the power to choose where they want to live and how they want to finance their purchase or repairs.

CONSUMER LENDING

We provided qualified consumers access to affordable loan programs to purchase or repair a home.

When Olga’s home options seemed limited and expensive, she found opportunity with INHP and the Near North Development Corporation.

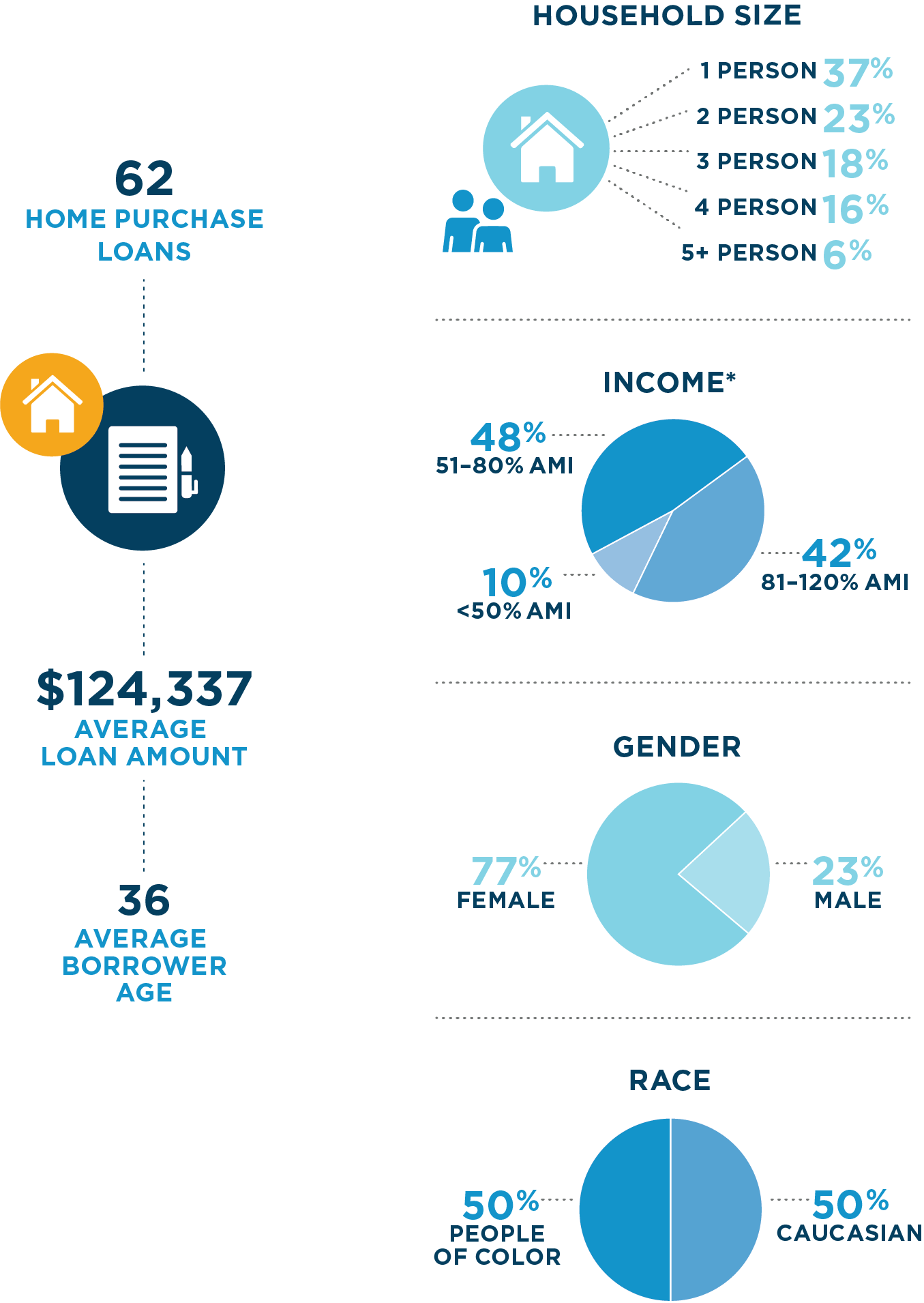

DEMOGRAPHICS: INHP home purchase loans

*AMI = Area Median Income.

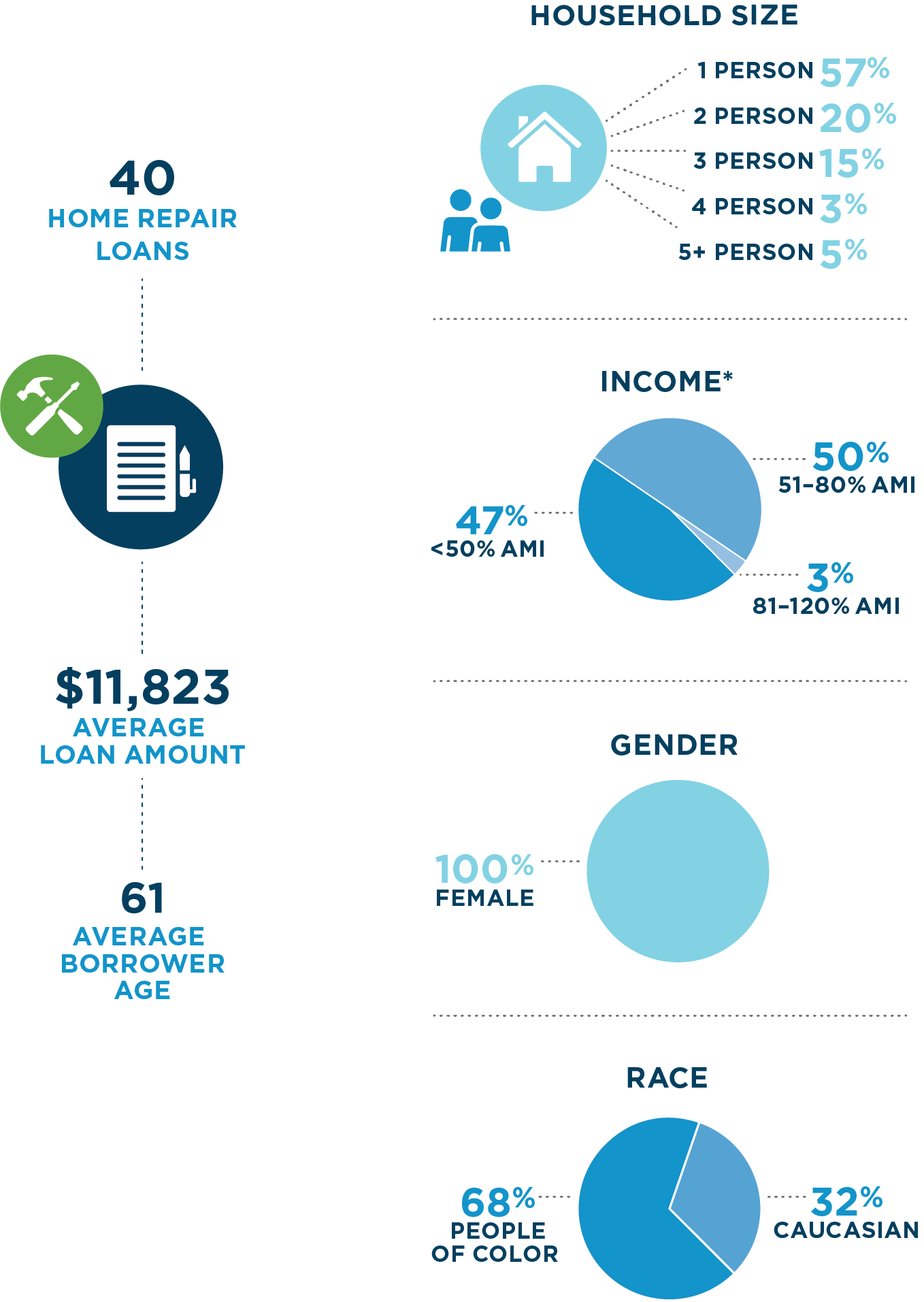

DEMOGRAPHICS: INHP home repair loans

*AMI = Area Median Income.

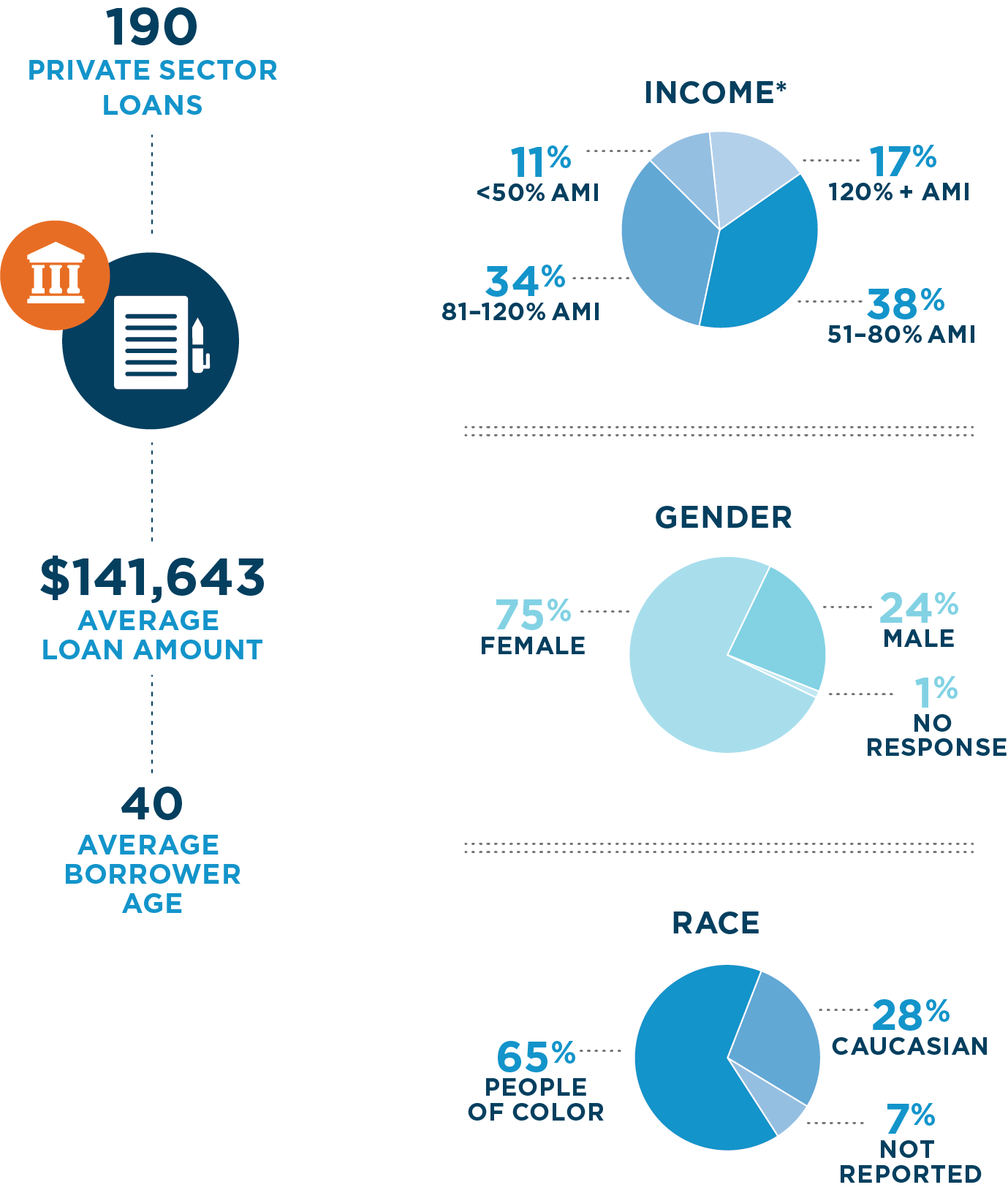

DEMOGRAPHICS: private sector loans

Local banks partner with INHP to offer competitive loan options, so we can offer our clients more mortgage options.

*AMI = Area Median Income.

INNOVATIVE LOAN PROGRAMS LEAD TO MORE OPTIONS

THE MARKET EXPANDER

The median home sales price in Marion County reached $190,000 last year, which is out of reach for many of the families INHP serves. In 2020, INHP secured a grant from the City of Indianapolis to pilot a new loan program that helps to address this challenge so buyers with low and moderate incomes can responsibly expand their purchasing power and compete in today's housing market.

The Market Expander pairs a below-market 20-year fixed rate first mortgage with a 0% interest second mortgage in which payments are deferred until years 21-30. It enables borrowers to:

- Access more housing options

- Access an affordable and sustainable loan

- Take advantage of the interest savings

- Increase the pace of equity/wealth accumulation

The program is exclusive to Marion County buyers earning a household income no more than 80% of the area median income.

EQUITABLE OPPORTUNITY

In July 2020, Moira participated in “A Conversation on Racial, Education, Economic and Health Inequality”, a panel presented by the Economic Club of Indiana.

RESEARCH-DRIVEN PROGRAMING

INHP commissioned research, Housing & Demographic Trends, observes various homeownership rates based on race and ethnicity.

KEY STRATEGY:

SINGLE- FAMILY HOUSING DEV.

As increasing home sale prices continue to create financial barriers for consumers, we’re developing homes that are priced affordably for qualified buyers in Marion County.

CONSTRUCTION PROGRESS

INHP continued to address the barrier of housing supply and changes in affordability with the construction of new, affordable single-family homes. Twelve of our homes completed construction, and 23 more were in process.

FUTURE CONSTRUCTION

INHP was invited to develop affordable homes in these neighborhoods beyond 2020.

| • Crown Hill | • Old Southside |

| • Mapleton-Fall Creek | • Riverside |

| • Norwood | • St. Clair Place |

Keirra worked with her real estate agent to buy this newly constructed affordable home in the Mapleton-Fall Creek neighborhood.

NEW CONSTRUCTION

In partnership with the Crown Hill, Riverside and Old Southside neighborhoods, we invested in the construction or rehabilitation of 28 new, affordable single-family homes. These houses create new opportunities for buyers while helping neighborhoods reach their plans and goals. Check out floorplans from the Old Southside and Riverside neighborhood homes.

KEY STRATEGY:

LAND BANKING

We’re making targeted investments along rapid transit lines to preserve the opportunity for affordable housing.

ADDING MORE SITES AND INCREASING ACCESS

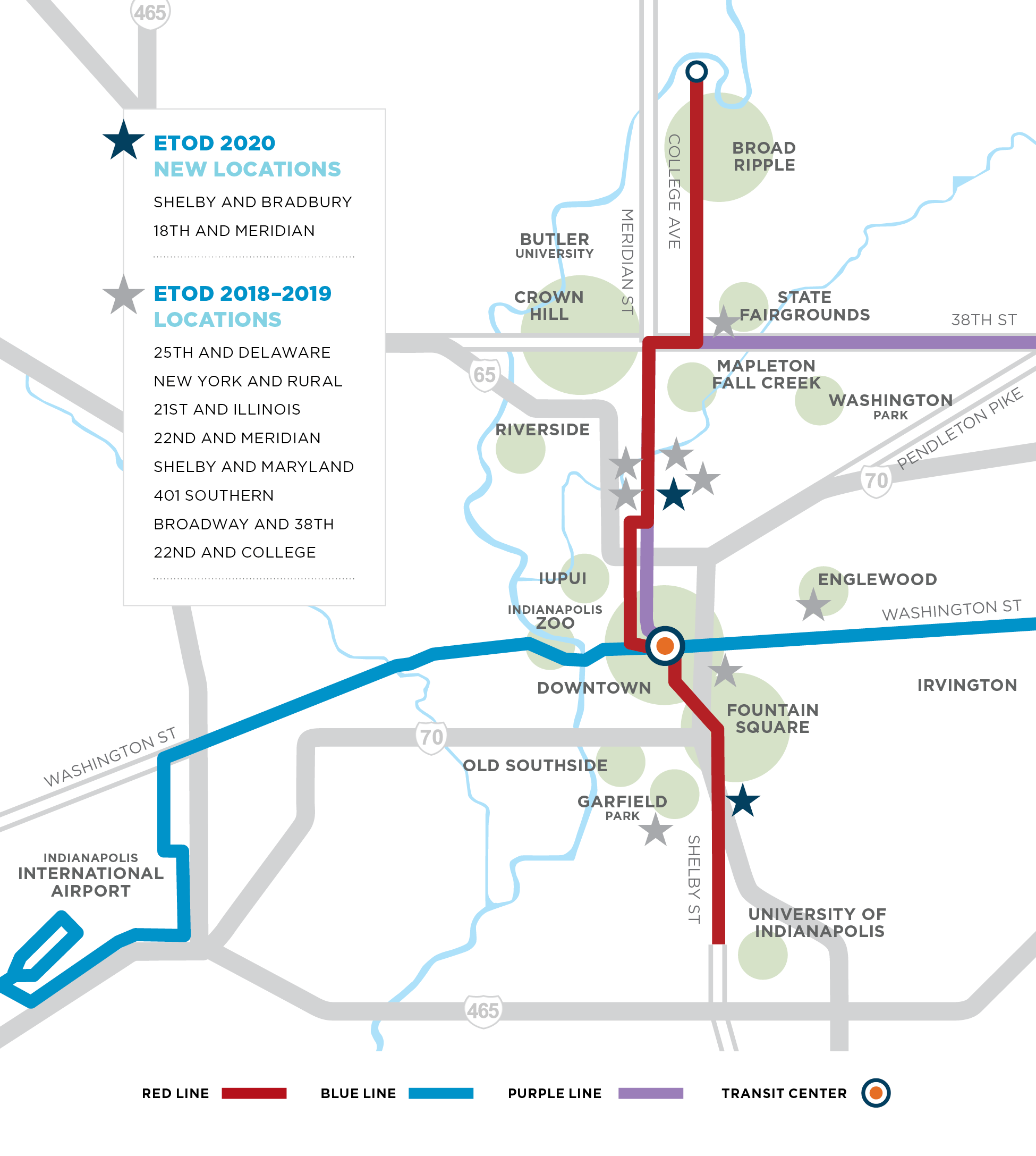

In 2020, we added two locations to our land bank of properties along rapid transit and frequent commuter routes — a total of 10. See the map to view all the Equitable Transit Oriented Development (ETOD) locations we have acquired.

Affordable housing along mass

transit lines can connect residents

to jobs, education, retail, cultural

amenities and health care.

ATTRACTING DEVELOPERS

Acquiring property is only one half of the work being done to carry out this strategy in the community. INHP also attracted for-profit and nonprofit developers that wanted to pursue the development of affordable multifamily housing. In 2020, eight of the 10 properties had purchase agreements in place with developers.

We hold each site until developers can prepare site plans, engage with the neighborhood, seek zoning changes as needed and prepare optimal financing.

KEY STRATEGY:

COMMUNITY LENDING

INHP supports neighborhood development and reinvestment opportunities by providing responsive and tailored community lending options that primarily yield the creation or preservation of affordable housing.

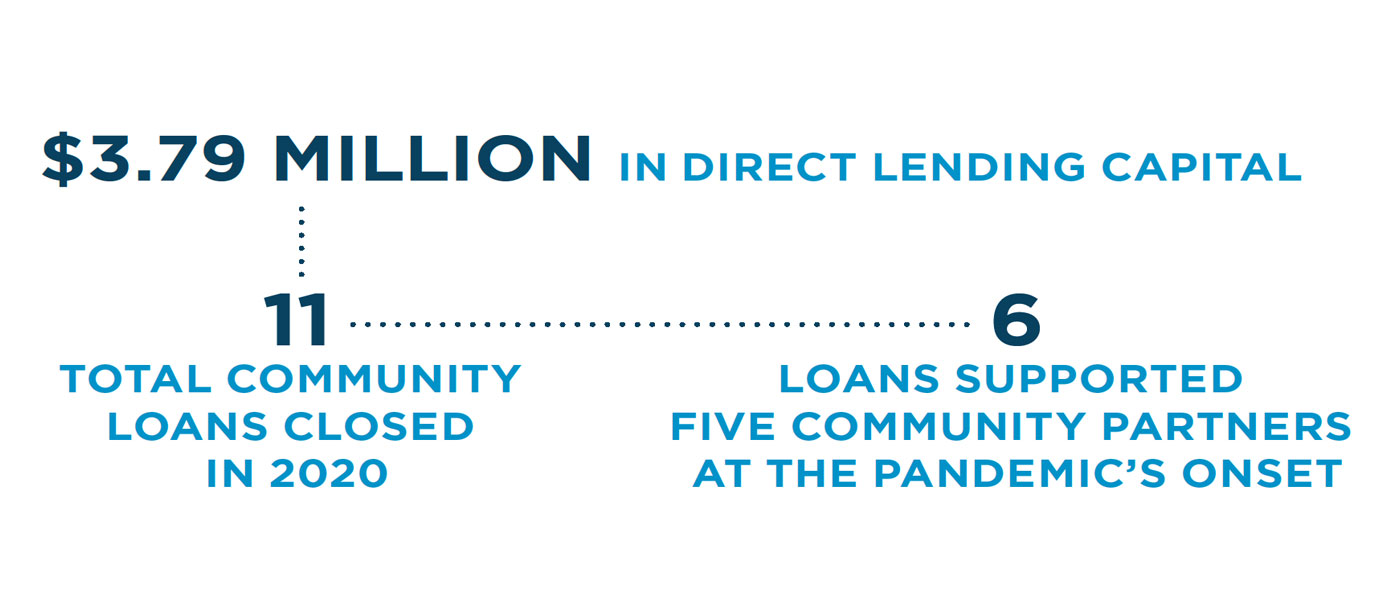

COMMUNITY LOANS

In 2020, we continued to offer a full range of affordable community development loans.

INHP IS A CDFI

As a U.S. Treasury certified Community Development Financial Institution (CDFI), INHP helps qualified nonprofits finance affordable housing initiatives. We provide construction financing, land loans, working capital and patient capital to support affordable housing development.

UNION AT 16TH

An INHP construction loan was part of the financing for Union at 16th, a multifamily affordable housing development west of the White River and north of the Ransom Place neighborhood. Each of the 159 apartments will be priced affordably.

EVALUATING AND ANTICIPATING NEED

ALWAYS INNOVATING

INHP is constantly looking for ways to meet the evolving needs of our community and the changing financial landscape. This includes piloting new programs in collaboration with other like-minded organizations in support of our mission, leveraging our seasoned relationships and establishing new ones.

ALWAYS INFORMED

INHP stays at the forefront of affordable housing conversations by sourcing formal research and sharing it with others. Visit our Research Library to explore how housing connects to health care, education, economic mobility and more.

INHP’S ANNUAL COMMUNITY BREAKFAST

In 2020, our first virtual Community Breakfast featured our clients and spotlighted our partnership culture. As we guided viewers through our data on the state of affordable housing in Marion County, we also asked for audience participation through a game of “Higher or Lower!”

KEY STRATEGY:

GRANT- MAKING

Grounded in our partnership culture, we’re trusted with philanthropic funds to strategically deploy into the community to positively impact the supply of affordable homes and the capacity of participants in the affordable housing system.

CONSTRUCTION AND REHAB GRANTS

- Greater Indy Habitat for Humanity

- Mapleton-Fall Creek Development Corporation

- Near Eastside Collaborative Partnership

- Near North Development Corporation

- Partners in Housing

- Renew Indianapolis Inc.

- Southeast Neighborhood Development

- Westside Community Development Corporation

$889,000 in operating support

to eight partners constructing, rehabbing and maintaining affordable housing units.

PLACEMAKING GRANTS

- EmployIndy/YouthBuild

- Harrison Center for the Arts

- Indy Gateway

- Kennedy King Memorial Initiative

- Near North Development Corporation

- NeighborLink Indianapolis

- Rebuilding Together Indianapolis

- Servants at Work (SAWs)

- Shepherd Community Center

- West Indianapolis Development Corporation

$112,000 to support

affordable housing and placemaking activities.

Partnership is in our name. But more importantly, partnership is a part of our culture.

COVID-19 IMPACT GRANTS

- Coalition for Homelessness Intervention and Prevention

- Coburn Place

- Eastern Star Church

- Englewood Community Development Corporation

- Fair Housing Center of Central Indiana

- Mapleton-Fall Creek Development Corporation

- Martindale Brightwood Community Development Corporation

- Neighborhood Christian Legal Clinic

- Partners in Housing

- Southeast Neighborhood Development

TECHNICAL ASSISTANCE GRANTS

- Crooked Creek Community Development Corporation

- Martindale Brightwood Community Development Corporation

- Near North Development Corporation

- Southeast Neighborhood Development

- West Indianapolis Development Corporation

SUPPLY STRATEGY IMPACT

Between community lending, single-family housing development and grantmaking in 2020, 1,111 affordable housing units were impacted and an additional 283 committed.

FINANCES

& DONORS

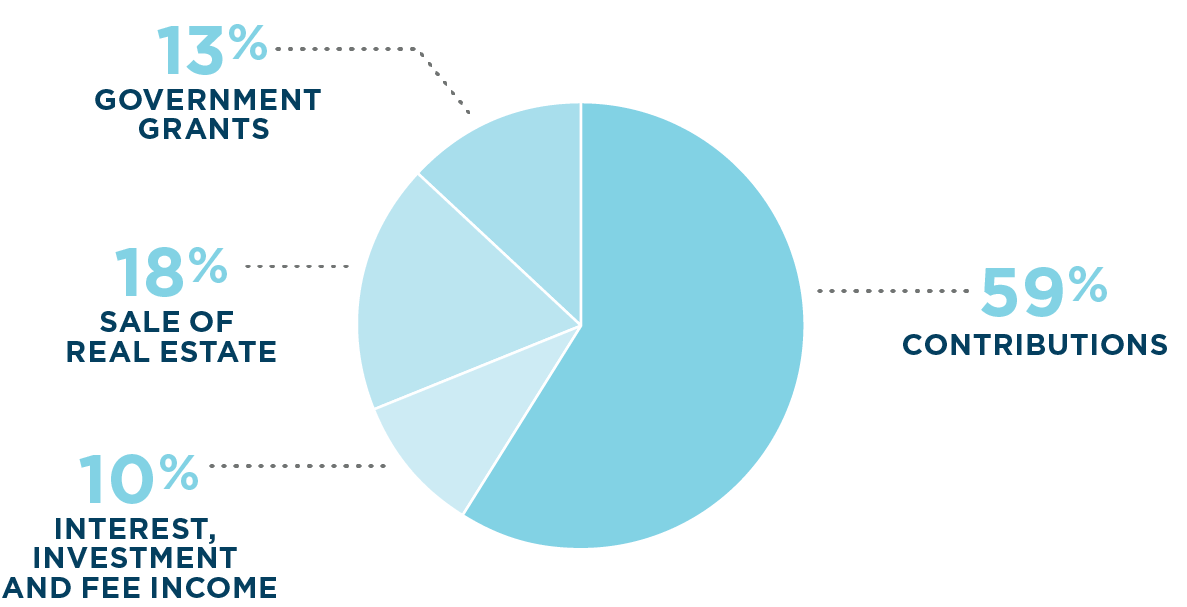

REVENUE, GAINS & OTHER SUPPORT

EXPENSES & OTHER COSTS

MORE DETAILS

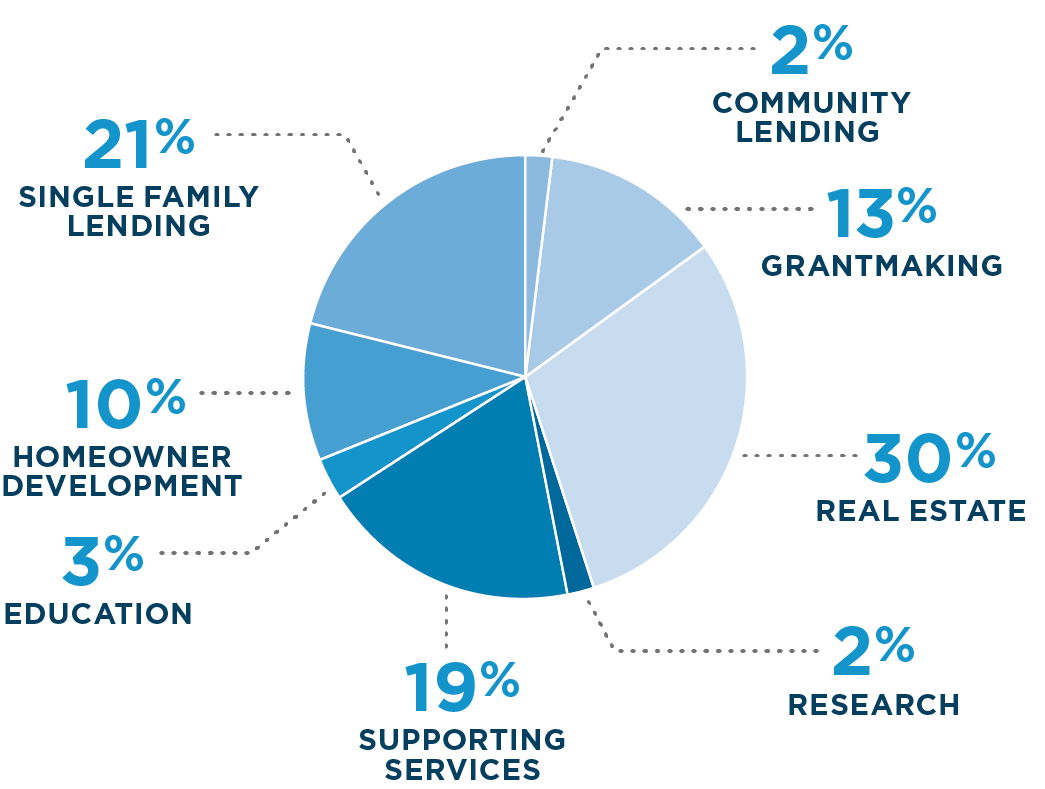

TOTAL INCOME: $12,107,799

- Total administrative expense: $1,828,369

- Total program expense: $10,129,665

- Total fundraising expense: $612,352

END-OF-YEAR NET ASSETS: $54,346,114

BOARD OF DIRECTORS

Bruce Baird

COO

Renew Indianapolis, Inc.

Jeff Bennett

Deputy Mayor of Community Development

City of Indianapolis

Bill Bower

Market President

First Financial Bank

Moira Carlstedt

President and CEO

INHP

John Corbin (Vice Chairperson)

Region President

The Huntington National Bank

Lacy DuBose

Vice President Agency Sales, North Central Market

State Farm

Greg Fennig

Chief Marketing Communications and Community Relations Officer

United Way of Central Indiana

Juan Gonzalez

President,

Central Indiana

KeyBank

Jennifer Green

Executive Director

Partners in Housing

– Indianapolis

Dr. Dawn Haut

CEO

Eskenazi Health Centers

John Hirschman

President and CEO

Browning

Jeffrey L. Kittle

President and CEO

Browning

Mark Kugar

Commercial Banking / Indiana Executive

BMO Harris Bank

Nicole S. Lorch

COO

First Internet Bank

Dr. Robert Manuel

President

University of Indianapolis

BOARD OF DIRECTORS (cont.)

Anthony “Tony” Mason

President and CEO

Indianapolis Urban League

Gina Miller (Chairperson)

CFO and COO

United Way of Central Indiana

Paul Okeson

Executive Vice President

Garmong Construction Services

Michael F. Petrie

Chairman and CEO

Merchants Bancorp

J. Albert Smith (Treasurer)

Chairman

JPMorgan Chase Indiana

Marshawn Wolley (Secretary)

President and CEO

Black Onyx Management, Inc.

ADVISORY BOARD

David Skeels

Founder, President

Vayurjant Capital Partners

Mary Lisher

Retired

Mary Jo Kennelly

Retired

Lynne Tamanini

First Vice President & Manager

The National Bank of Indianapolis

Thomas C. Dawson

Executive Vice President and Chief Administrative Officer

Strada Education Network

Kenneth J. Herrmann

Senior Vice President / CRE Managing Director

Fifth Third Bank

Michael A. Fritton, CPA

Principal

Somerset CPAs and Advisors

WITH YOUR HELP, WE WERE ABLE TO SERVE NEARLY 1,500 FAMILIES DURING 2020.

SPECIAL THANKS TO OUR DONORS

$1,000,000 or more

Lilly Endowment Inc.

$100,000 to $999,999

City of Indianapolis

Community Development Financial Institutions Fund (CDFI)

Federal Home Loan Bank of Indianapolis,

in honor of Moira Carlstedt

KeyBank

KeyBank Foundation

$50,000 to $99,999

Housing Partnership Network

Huntington Bank

The Cummins Foundation

Wells Fargo

$25,000 to $49,999

BMO Harris Bank

Fifth Third Bank

Fifth Third Bank Foundation

First Merchants Bank

Marion County Public Health Department

State Farm

Union Savings Bank

$5,000,000 OR MORE

Lilly Endowment Inc.

$1,000,000 – $4,999,999

City of Indianapolis

$100,000 – $999,999

Community Development Financial Institutions Fund (CDFI)

KeyBank

KeyBank Foundation

$50,000 – $99,999

Fifth Third Bank

Fifth Third Bank Foundation

Herbert Simon Family Foundation

Housing Partnership Network

JPMorgan Chase & Co.

$25,000 – $49,999

Glick Philanthropies

Bob and Melody Grand

Indiana Members Credit Union

Marion County Public Health Department

David W. and Jennifer F. Skeels

Rick and Tara Skiles

Michael L. Smith and Susan L. Smith Family Fund, a fund of the Hamilton County Community Foundation

State Farm

Union Savings Bank

Wells Fargo

$10,000 – $24,999

BMO Harris Bank

Care Institute Group, Inc.

Michael Daniel and Angie Marshall

First Financial Bank

First Merchants Bank

Huntington Bank

MIBOR REALTOR® Association

Al and Maribeth Smith

The Indianapolis Foundation, a CICF affiliate, in honor of Marshawn Wolley

The Sablosky Family Foundation, a fund of the Hamilton County Community Foundation

$5,000 – $9,999

AES Indiana

Anonymous

Anonymous

Ascension St. Vincent

Citimark

Citizens Energy Group

Eli Lilly and Company

Framework Homeownership

Horizon Bank

Indy Chamber

Kittle Property Group, Inc.

Jeffrey Kittle

Mary K. Lisher

Nicholas H. Noyes, Jr., Memorial Foundation

Old National Bank

OneAmerica

PNC

Regions

Robert and Angela Evans

The National Bank of Indianapolis

United Way of Central Indiana

$2,500- $4,999

American Structurepoint, Inc.

Associated Bank

Barnes & Thornburg LLP

BKD

Bose McKinney & Evans LLP

Browning

Busey Bank

Eastern Star Church

Eskenazi Health

Faegre Drinker Biddle & Reath LLP

First Internet Bank

Lois Hanson

Indiana Farm Bureau Insurance

Indianapolis Local Initiatives Support Corporation

Klapper Family Foundation, Inc.

Michaelis Corporation

Jake and Becky Sturman

$1,000 – $2,499

Michael Alley

Anonymous

Bernard Health

Tim and Amy Diersing

Lacy DuBose

Endress+Hauser, Inc.

Federal Home Loan Bank of Indianapolis

Greg Fennig

Flaherty & Collins Properties

Nichole M. Freije

Michael Fritton

John and Barbara Gallina

Greg Gault and Jeanne Maurer-Gault

Joseph and Stacey Hanson

Jeffrey Harrison

Dr. Dawn Haut

Mr. Kenneth Herrmann

John Hirschman

Morgan and Brandon Hoover

Indianapolis Airport Authority

Troy and Bob Kassing

Jeff Curiel and Kate Kester

Matt and Andrea Kleymeyer

John L. Krauss

Mark Kugar

Lake City Bank

Sam and Kim Laurin

Dr. Kathleen Lee

Benjamin A. Lippert

Nicole S. Lorch

Kathy and Carey Lykins

Joy and Tony Mason

Tim Massey

Charles Mercer

Merchants Capital Corp.

Alan O'Rear

Paul Okeson

Michael F. Petrie

Kenny and Cherie Pologruto

Pyxso, LLC

Michael C. Rechin

Mr. and Mrs. N. Clay Robbins

Michael J. Stewart

$500 – $999

Associated Insurance Services LLC

Deb and Ron Berry

Centier Bank

John Corbin

CRIPE Architects and Engineers

Don and June Dawson

John and Palak Effinger

Freije Brands

Genevieve and Dan Gaines

Juan Gonzalez

Jeff and Judy Good

Gregory Home Inspections, Inc.

IU Lilly Family School of Philanthropy

Mary Jo Kennelly

Kroger

Ruth and Ralph Lusher, in honor of Melissa Turner

Robert Manuel

Jennifer and Jeffery Meeker

Trevor and Martita Meeks

Gina Miller

Mr. Jeffery J. Qualkinbush

Greg Reiley

Mark and Brenda Rodgers

Mr. and Mrs. David G. Sease, in honor of Moira Carlstedt

Stifel | Endeavor Investment Group

Strategic Capital Partners

Denny Southerland

Steve and Tina Sullivan

The Peterson Company

Ruth Wooden

$1 – $499

Anonymous

Anonymous

Anonymous

Anonymous

Rebecca Adkins

Barb Armbruster

Deborah Armbruster, in honor of Barb Armbruster

Bank of America

Alex and Amy Barrett

Jeff Bennett

DeBorah Benson

Pamela Black

Summer Black

Dr. Philip Borst

Bill Bower

Todd Bright

Arias Brown

David and Donna Butcher

Butler University

Steven Campbell

Erika Cheney

Kyle Cheverko, in honor of Jennifer Meeker

Cinnaire

Michael Cloud

Laura and Greg Cochran

Todd Cook

Timothy Coxey

Brandi Davis-Handy

Cheri and Rollin Dick

Thomas and Nancy Dinwiddie

Melinda Douthitt

Norma and Michael Duncan

Bea Dye

EmployIndy

Andretta Erickson

Cassandra Faurote, in honor of Jennifer Meeker

Federal Reserve Bank of Chicago

Margie Fee

Jessica Foster

Ernest Fry, in honor of Sherry Loller

Mike Garrett

Jay and Susan Geshay

Patrick Goble

Grants Avenue, LLC

Greater Indy Habitat for Humanity

Jennifer Green

Groundwork Indy

Tom Guevara

John E. Hall

Dan L. Hampton

Ryan Hanson

Dan Hatfield

Robin Hayes, in honor of Ashlee Willocks

Samuel and Margaret Hazlett

Kate Henderson

Brian Henning

Sherry Hopkins

Bonita Hurt

Donald Hutchinson

Matt Impink

Indianapolis Housing Agency

Indy Gateway

Mali Jeffers

John Boner Neighborhood Centers

Thomas and Kellie Johnson

Laurie Jones

Patricia Jones

Keystone Group

Tom Kientz

Jeremy Kranowitz

Kurt Kreilein

Christine Laker, in honor of Morgan Hoover

Austin Larr

Ms. Deborah Lawrence, in honor of Moira Carlstedt

Sherry Loller

John Marron

Will Marts

Thomas Maxwell

Kylie McFarland

Julia Melendez

Midtown Indianapolis, Inc.

David Miller

Mary Myers

David Nash

NeighborLink Indianapolis

Mrs. Danita O'Neal-Winters

Partners in Housing

Jacqueline Pimentel-Gannon

Jody Pope

Mamon Powers III

Patricia B. Prosser

Katie Quillen

Chris Ragland

Rebuilding Together

William and Courtney Reeves

Phillip W. Reid

Gary Reiter

Renew Indianapolis Inc.

Rebecca A. Richardson

Lee Robinson

Andrew Rodgers

Anna Ross and David Kosene

Priscilla Russell

Mark and Julanne Sausser

Amanda Schoonveld, in honor of Ashlee Willocks

Todd and Linda Sears

Teia Sebree

Rachel Semple

Len and Constance Smith

Ruth Soper

Southeast Neighborhood Development, Inc. (SEND)

Shelley Specchio

Susan Springirth

Maggy Staab

Jenny Stamm, in honor of her friend Heather Bolinger

Denny Stephens

Grant and Christine Swarm

Lynne Tamanini

Leopoldo Tamez

Phil Terry

The ORL Foundation Inc.

Scott and Sharon Thiems

Christa Thomas

Vivian Thomas

Kathryn and Phillip Tremblay

Anthony and Melissa Turner

Lynn Tyler

University of Indianapolis

Brandi Vierling

Michele Wann

Marilyn Welker, in honor of Laura Cochran

West Indianapolis Development

Corporation

Marshawn Wolley

Ashlee and Jordan Willocks

Shannon Zajicek

GIFT IN-KIND

Advantage Housing Inc.

Anonymous

Barb Armbruster

Alex and Amy Barrett

Deb and Ron Berry

BRICS

Citimark

CityStrategies, LLC

Laura and Greg Cochran

Timothy Coxey

Davis Building Group

John and Palak Effinger

Faegre Drinker Biddle & Reath LLP

Margie Fee

First Financial Bank

Genevieve and Dan Gaines

Hambone's Trivia

Ryan Hanson

Morgan and Brandon Hoover

Ice Miller, LLP

Thomas and Kellie Johnson

Kroger

Sherry Loller

LUNA Language Services

Jennifer and Jeffery Meeker

Microsoft

Pinheads

Kenny and Cherie Pologruto

Len and Constance Smith

Anthony and Melissa Turner

Valeo Financial Advisors

Wooden & McLaughlin LLP now Dinsmore & Shohl LLP

GIFTS IN WILL

Andrea Riquier

Susan Springirth

INHP is honored to accept legacy gifts. Contact Morgan Hoover, VP of Philanthropy and Marketing, at mhoover@inhp.org to learn more.