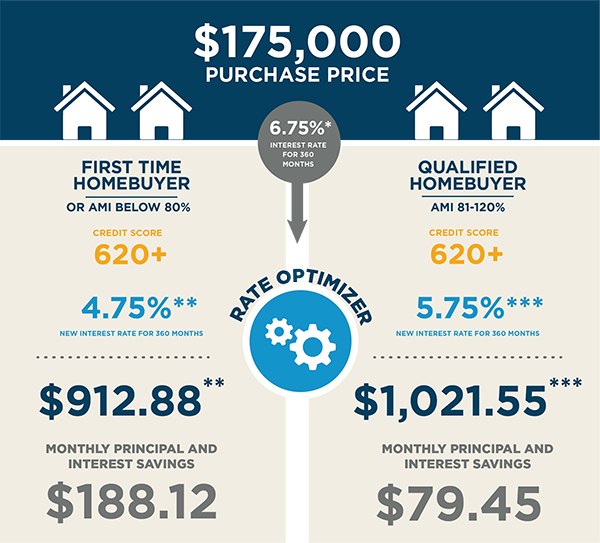

RATE OPTIMIZER

A loan program that uses a non-traditional way to create a fixed, affordable interest rate and an optimal monthly payment.

PROGRAM DETAILS

HOW DOES IT WORK?

Because INHP bases its interest rate on a different system than most lenders, the Rate Optimizer's fixed-interest rate may be up to 2% lower than traditional mortgage programs.

PROGRAM ELIGIBILITY

Must be a first-time homebuyer or buying a home in a low- or moderate-income census tract

Must be buyer's primary residence in Marion County

Minimum 620 credit score (if below 680, a positive rental history required)

$500 minimum required cash investment

Household income cannot exceed 120% AMI (contact for more details)

Successfully complete INHP's Homebuyer Education class

Example: Estimated loan terms of a traditional mortgage compared to a Rate Optimizer mortgage:

- *Traditional mortgage based on a $175,000 Purchase Price: $169,750 Loan Amount (or 3% down), 6.750% interest rate (6.955% APR), 640 credit score, $1,101.00 monthly principal and interest payment for 360 months.

- **Rate Optimizer mortgage for first-time homebuyers with 620 credit score and below 80% AMI: $175,000 Loan Amount (or 0% down), 4.750% interest rate (4.926% APR), and $912.88 monthly principal and interest payment for 360 months.

- ***Rate Optimizer for borrowers with 81% AMI or greater and 620 credit score: $175,000 Loan Amount (or 0% down), 5.750% interest rate (5.937% APR), $1021.55 monthly principal and interest payment for 360 months.

Income and eligibility restrictions apply. Rates and availability subject to change without notice.