Posts by Whitney Klinck

INHP adds more than $12 million to support Marion County affordable housing initiatives

Funds expected to help hundreds of residents with low and moderate incomes find affordable lending and housing opportunities INDIANAPOLIS (June 17, 2025) – Working together with local and national nonprofits and six financial institutions, the Indianapolis Neighborhood Housing Partnership (INHP) leveraged its role as a community development financial institution by delivering more than $12 million…

Read MoreThree ways to give your home’s exterior a summer spruce-up

Want to take advantage of the summer weather by tackling exterior home projects? Checking these DIY tasks off your list will help maintain your home’s exterior, while making your property look more inviting. Power Washing – A power washer can easily spray away the dirt, debris, mold and moss that have accumulated on your…

Read MoreHow INHP safeguards your data

INHP is a not-for-profit organization, yes. But our top priority is safeguarding our clients’ data. So any personal or financial information you share with us, stays secure with us. Whenever you apply for a mortgage loan at a bank, INHP or other lender, you are required to provide information about your work, income sources and…

Read MoreGet a lower, optimal rate with INHP’s Rate Optimizer loan program

Is a lower fixed-interest rate mortgage more optimal than a more expensive one? Yes, of course! This is why INHP created the Rate Optimizer loan program for 30-year mortgages – to optimize the interest rate and provide you with one of the most affordable mortgages possible. For first-time homebuyers and income-eligible families, the lower interest…

Read MoreRenter’s Resources

For helpful information for renters, click on the links below: Renter’s Guide Renting 101 Tenant’s rights: Fair Housing Center of Central IN IN Civil Rights Commission/Discrimination

Read MoreKeeping Up with Spring Home Maintenance

Indiana is no stranger to a fake spring or two – or what feels like 35 fake springs. But now that flowers are starting to bloom, regular warm weather appears to be on its way to stay for a while. Spring is the time to check off home-maintenance tasks and prepare your house for summer.…

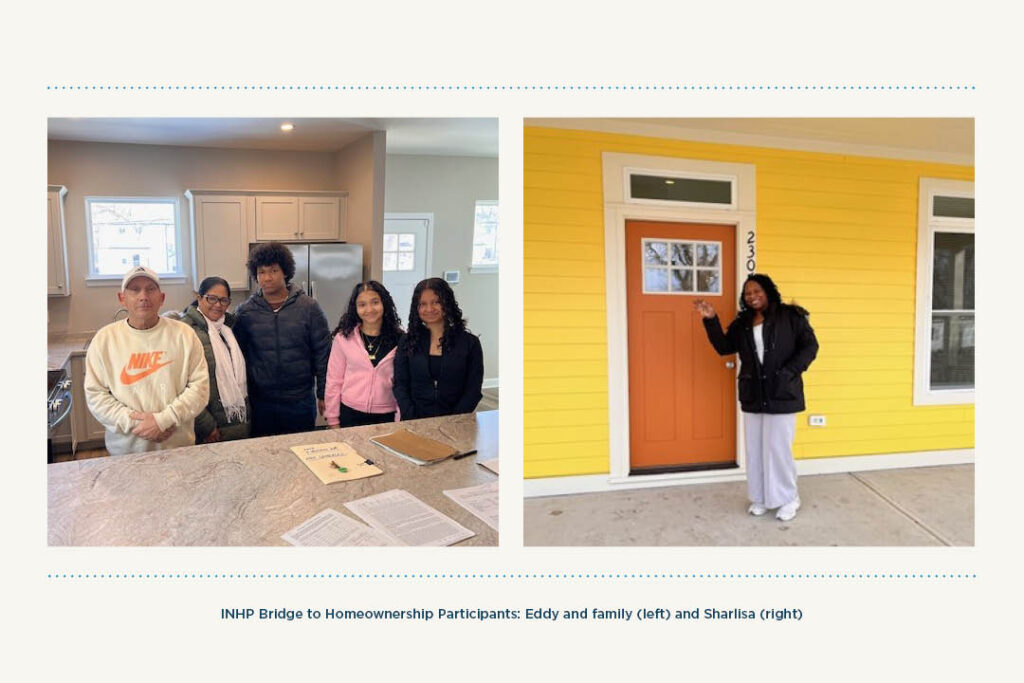

Read MoreBridge to Homeownership program offers rent-to-buy with added financial stability

The right steps to homeownership are different for everyone. For many, INHP’s Bridge to Homeownership – a program that allows you to choose an affordable home in Marion County (Indianapolis) to rent first and buy later – is a smart option for those who qualify. The program is designed to create stability as you work…

Read MoreINHP promotes Trevor Meeks to Chief Consumer Solutions Officer

INDIANAPOLIS (March 11, 2025) – The Indianapolis Neighborhood Housing Partnership® (INHP) announces the promotion of Trevor Meeks to chief consumer solutions officer. Meeks will lead the strategic direction and implementation of all INHP consumer solutions programming, including homebuyer and financial literacy education, homeownership advising and consumer lending. Meeks was previously vice president of homeownership initiatives…

Read MoreGet an exclusive 4.99% fixed interest rate (or lower) on any INHP first mortgage loan

INHP is taking the guess work out of buying a home at the right time…(it’s now). From now until December 31, 2025, the interest rate on all INHP first mortgage loans will NOT exceed 4.99%*. In fact, your interest rate might be even lower than 4.99% if you qualify for one of INHP’s unique loan…

Read MoreINHP selects eight grantees to receive funding for neighborhood development initiatives

$900,000 to be awarded across Marion County INDIANAPOLIS (Jan. 29, 2025) – The Indianapolis Neighborhood Housing Partnership® (INHP) announces eight neighborhood-serving organizations receiving grants to support their affordable housing preservation and development efforts, and collaborations for enhancing affordable housing in Indianapolis. Called the Indianapolis Neighborhood Development Initiative (INDI), this year’s program will distribute $900,000 total…

Read More